Learn. Grow. On Point.

Resources that deliver on point insights to keep your financial health in tip-top shape.

🎓 SRNA? Get your money kit here.

Topics

CRNA in a Cash Crunch? The Smart Order To Tap Funds

CRNA Case Study: 1099 vs. W-2 – Same Hours, Different Dollars ($32,143 Difference)

Even God Would Get Fired: What This Tells CRNAs About Investing Smarter

The One Big Beautiful Bill Act (OBBBA): What It Means for CRNAs

Student Loan Interest Resumes: CRNA Urgent Update

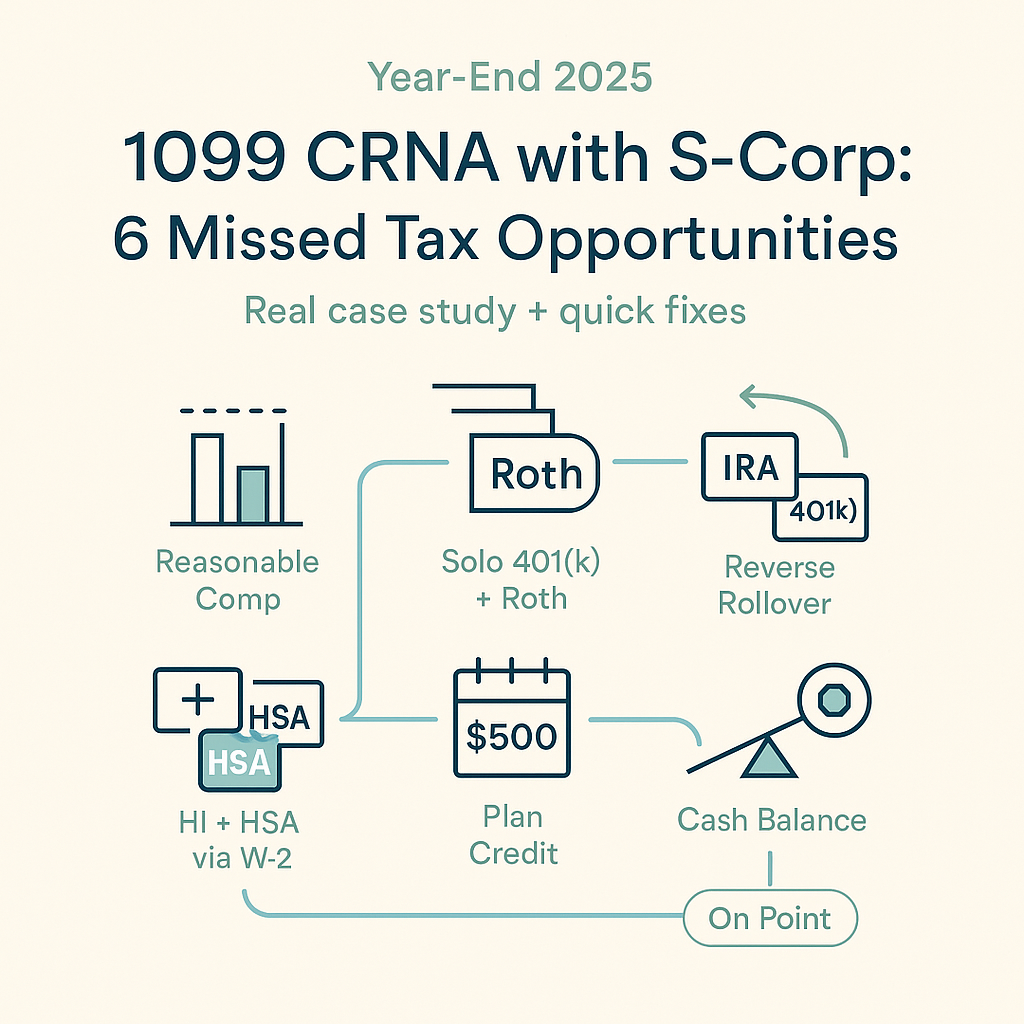

The Hidden Payroll-Tax Hack for 1099 CRNAs: Run Your Health Insurance & HSA Through Your S-Corp

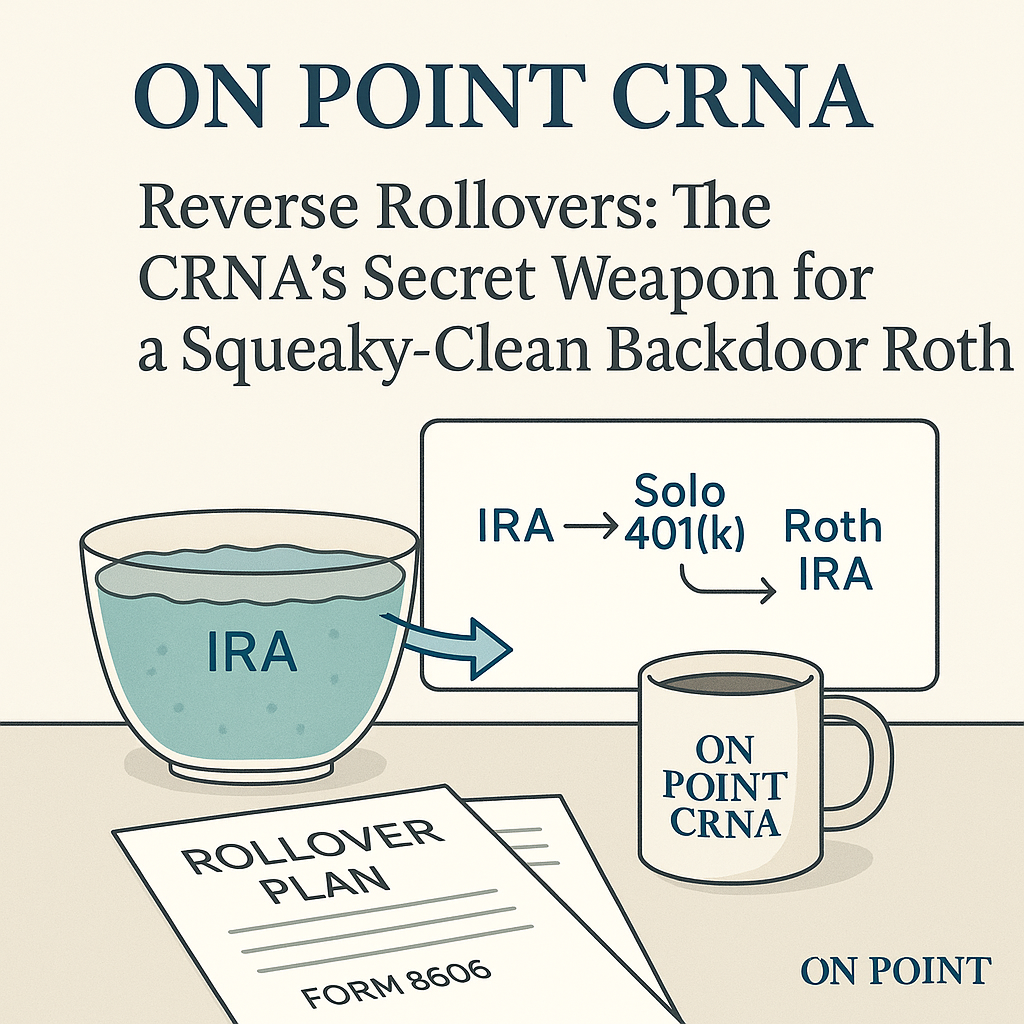

Reverse Rollover to a Solo 401(k): The CRNA’s Shortcut to a Squeaky-Clean Backdoor Roth

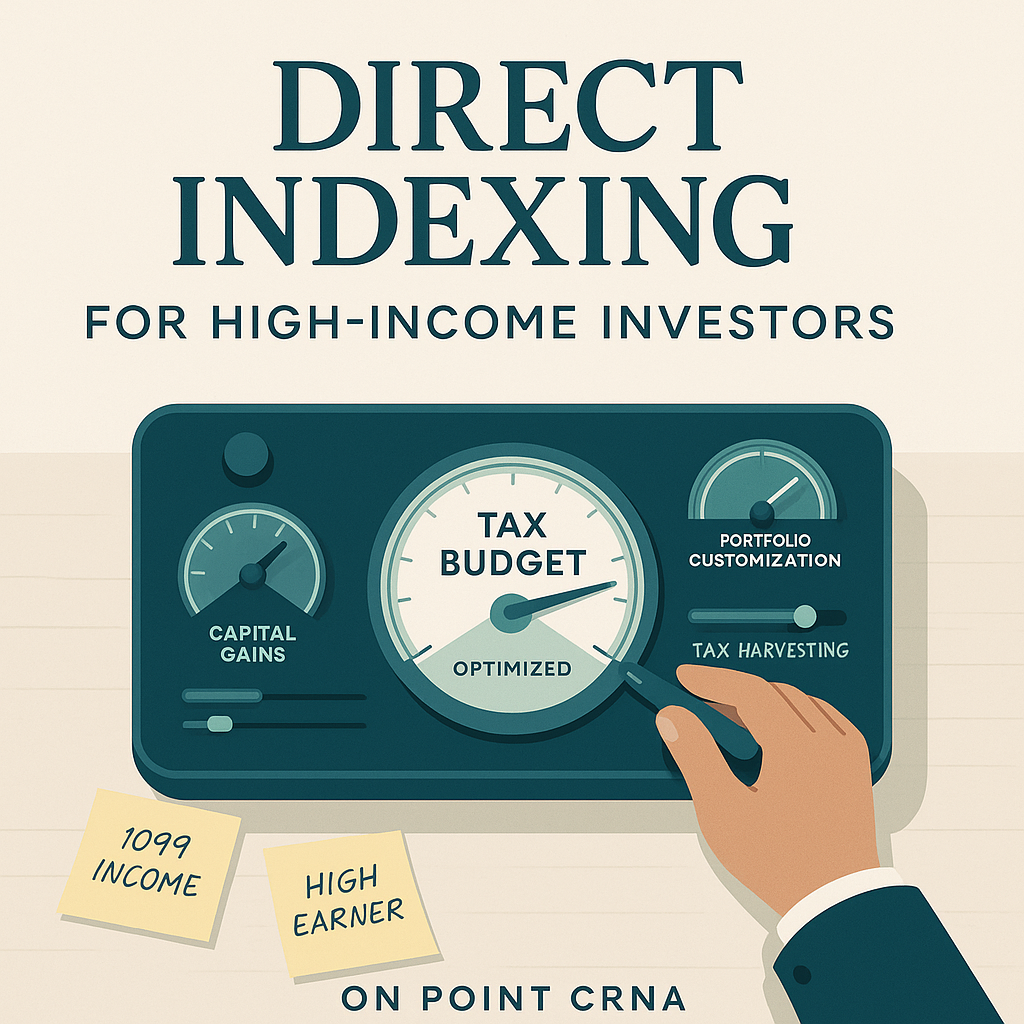

Direct Indexing for High-Income Investors

Monitoring Your Financial Vitals: Real Estate Term (Rt) for CRNAs

🛍️ CRNA Buyer’s Guide: How to Pick a Financial Advisor (Without Getting Played)

Congress Is Changing the Tax Rules – CRNAs, Here’s What That Means

Bookkeeping for CRNAs: Why It’s Simpler (and More Important) Than You Think

Congress Is Changing the Tax Rules – CRNAs, Here’s What That Means

Bookkeeping for CRNAs: Why It’s Simpler (and More Important) Than You Think

What CRNAs Need to Know About Potential 2025 Tax Changes

Tax-Loss Harvesting for CRNAs: Turn Your Investment Lemons Into Tax Lemonade with Direct Indexing

Corporate Transparency Act (CTA) Compliance for CRNAs with LLCs: Quick & Easy BOI Filing Guide

8 Essential Year-End Tax Strategies for CRNAs: Maximize Your 2024 Savings

Is a Business Checking Account a Must for Your 1099 Income?

Choosing Between W-2 and 1099: When Does W-2 Make More Sense? A CRNA Poll Analysis

1099 vs W2 for CRNAs: How to Compare

Sole Proprietor or S-Corporation? Deciding for Your 1099 Income

CRNA 1099 Case Study: Solo 401(k) + Mega-Backdoor Contribution

End-of-Year Tax Planning Essentials for CRNAs

No post found!

CRNA 1099 Case Study: Solo 401(k) + Mega-Backdoor Contribution

2023 Market Review: Investment Lessons Learned & How to Apply Them in 2024

End-of-Year Tax Planning Essentials for CRNAs

Bullish vs. Bearish: Navigating the Market as an Investor & CRNA in 2024

The #1 Tax Strategy Worth Exploring for Student Registered Nurse Anesthetists (SRNAs)

Why the Games Should Stop With GameStop.

No post found!

No post found!