The Payroll-Tax Blind Spot Most 1099 CRNAs Still Miss

Let your S-Corp handle family health costs and watch FICA shrink—no scalpel required.

A Quick Anecdote

Last week a CRNA client texted me:

“Ben, my take-home feels light. Am I overpaying payroll taxes?”

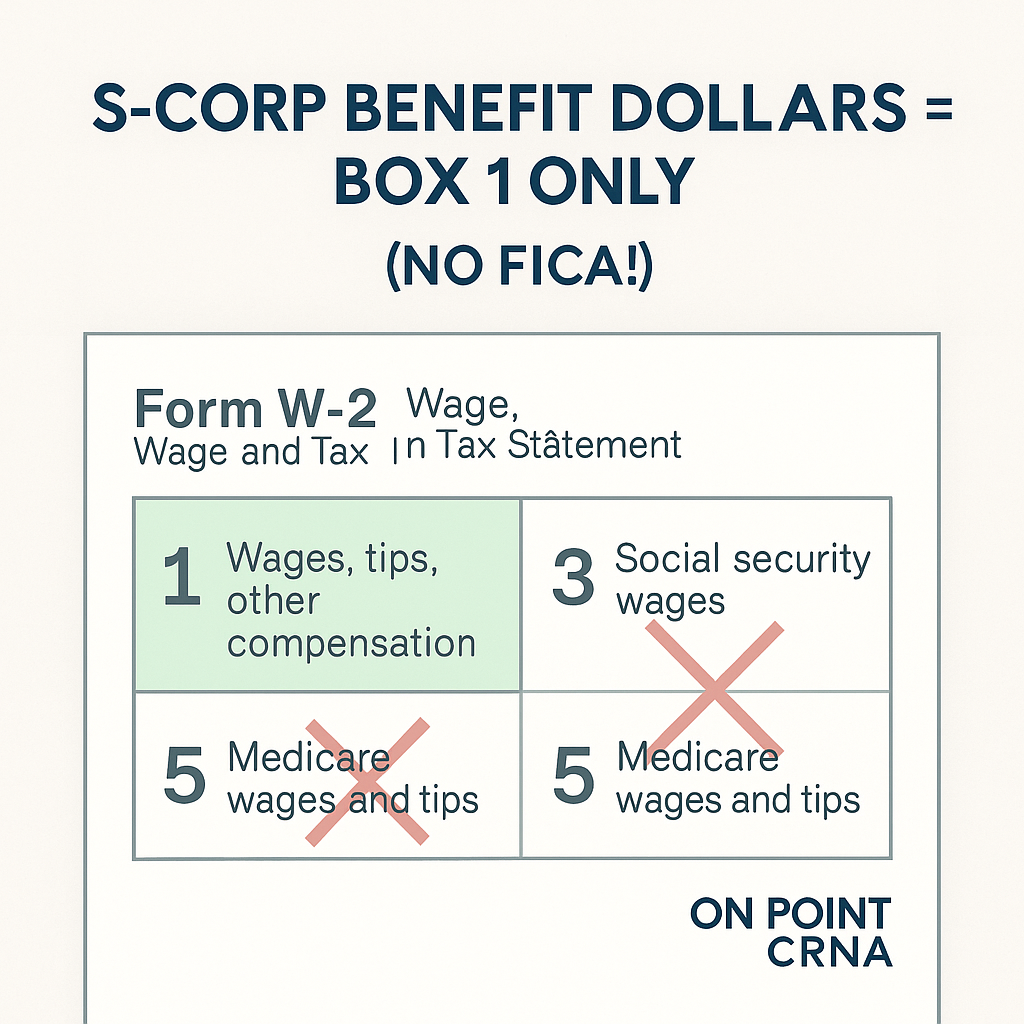

Her S-Corp salary was a clean $150k, yet she paid family health premiums and maxed her HSA out of pocket. Translation: she tipped Uncle Sam an extra three grand. Let’s plug that leak.

How the IRS Treats Health Insurance & HSAs for >2% S-Corp Owners

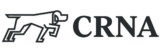

- Health-insurance premiums paid or reimbursed by the S-Corp are included in Box 1 of your W-2—taxable for income tax—but excluded from Social Security and Medicare wages (Boxes 3 & 5). See IRS Notice 2008-1.

- HSA contributions work the same way. If the S-Corp pays them and they hit Box 1 only, you still claim the above-the-line HSA deduction. Confirmed in the IRS Instructions for Form W-2.

WCG CPAs illustrate this in their handy Section 105 article; their table inspired the one below.

Numbers in Action — $3,106 Back in Your Pocket

| Without S-Corp Reimbursements | With S-Corp Paying Premiums & HSA | |

|---|---|---|

| Net 1099 Income | $350,000 | $350,000 |

| Reasonable Salary (Box 1) | $150,000 | $150,000* |

| Health-Insurance Premiums | — | $12,000 |

| HSA Contribution (Family 2024 cap) | — | $8,300 |

| Social-Security & Medicare Wages (Boxes 3 & 5) |

$150,000 | $129,700 |

| FICA at 15.3 % | $22,950 | $19,844 |

| Annual Payroll-Tax Savings | — | ≈ $3,106 |

*Cash salary is effectively $129,700; the $20,300 of benefits “tops it off” to keep Box 1 at $150k—mirroring the WCG example.

Why It Works

Those benefit dollars live in Box 1 so they’re income-taxable, yet they skip FICA. Your S-Corp deducts both wages and benefits, and you grab:

- Self-employed health-insurance deduction (Schedule 1, Line 17)

- HSA deduction (Form 8889)

If your salary tops the $176,100 Social-Security wage base for 2025 (SSA), you still avoid the 2.9 % Medicare tax on those benefit dollars.

Step-by-Step Payroll Optimization

- Tell Gusto/ADP/Paychex to reimburse $1,000 per month for medical and $691.67 per month for HSA. Code both to Box 1 only.

- Lower the cash portion of your paycheck so Box 1 still shows $150k.

- Draft board minutes or a shareholder resolution documenting the plan (thrilling, I know).

- On your personal return, claim the two deductions above.

- High-five yourself for not tipping the IRS.

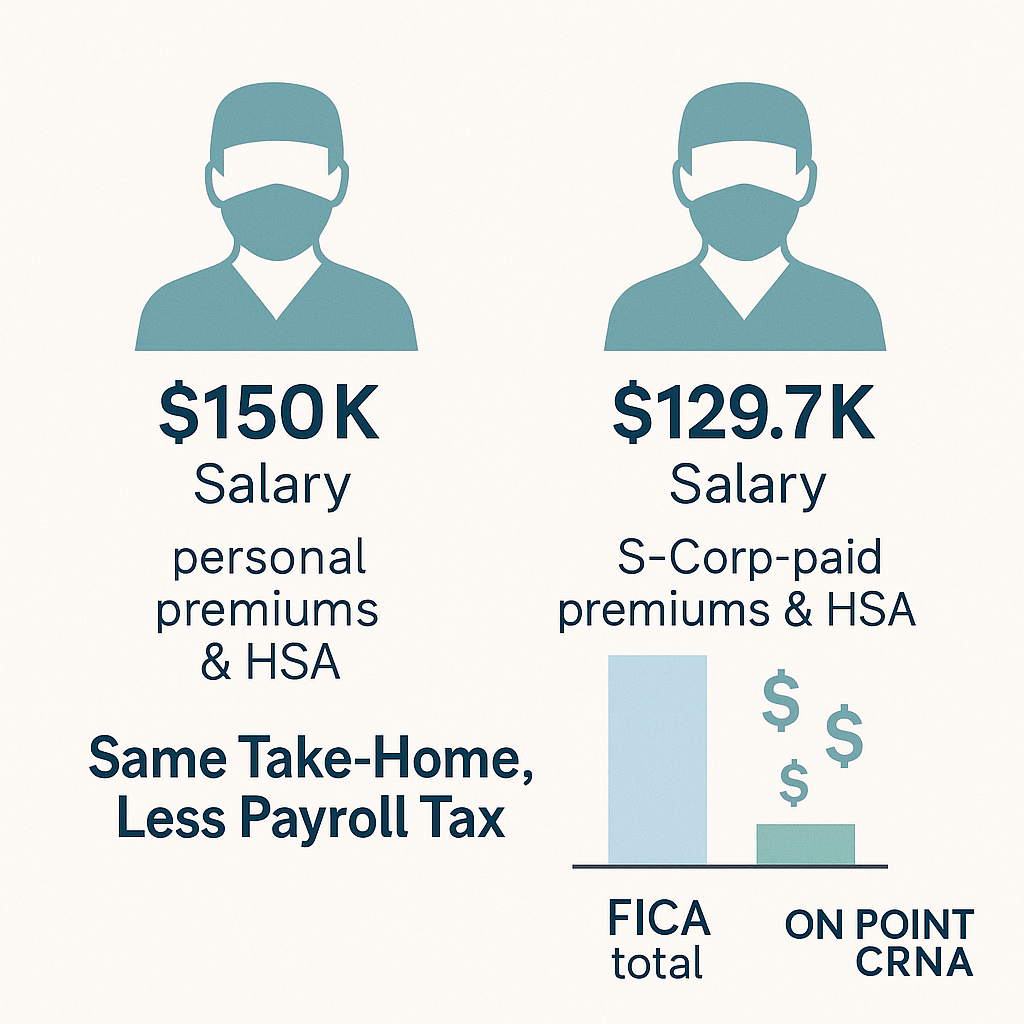

Common Mistakes to Avoid

- Mixing personal & business funds. No reimbursement = no deduction.

- Using a non-HDHP. 2025 family HDHP minimum deductible is $3,300 (Rev. Proc. 2024-25).

- Skipping the paperwork. The IRS loves documentation even more than propofol.

Ready to Stop Over-Paying?

More CRNA-Focused Reads

- Reverse Rollover: Keep Your Backdoor Roth Clean

- Mega-Backdoor Roth: Quantifying the Long-Haul Win

- Direct Indexing for High-Income Investors

Disclaimer: Barnhart Wealth Management (DBA On Point CRNA) is a registered investment adviser offering services in Michigan and other jurisdictions exempt from registration. This content is for informational purposes only and does not constitute advisory services or sale of securities. Investing involves risk, including loss of principal. Comments and recognitions do not guarantee future results.