👥 Our Identity, 🎯 Our Mission, 🔄 Our Approach

The answers you’ve been searching for.

- What services do you offer?

- What can I expect if we work together?

- How do you get paid?

- How do I become a client?

Build it.

Grow it.

Share it.

Dream it.

Protect it.

Keep it.

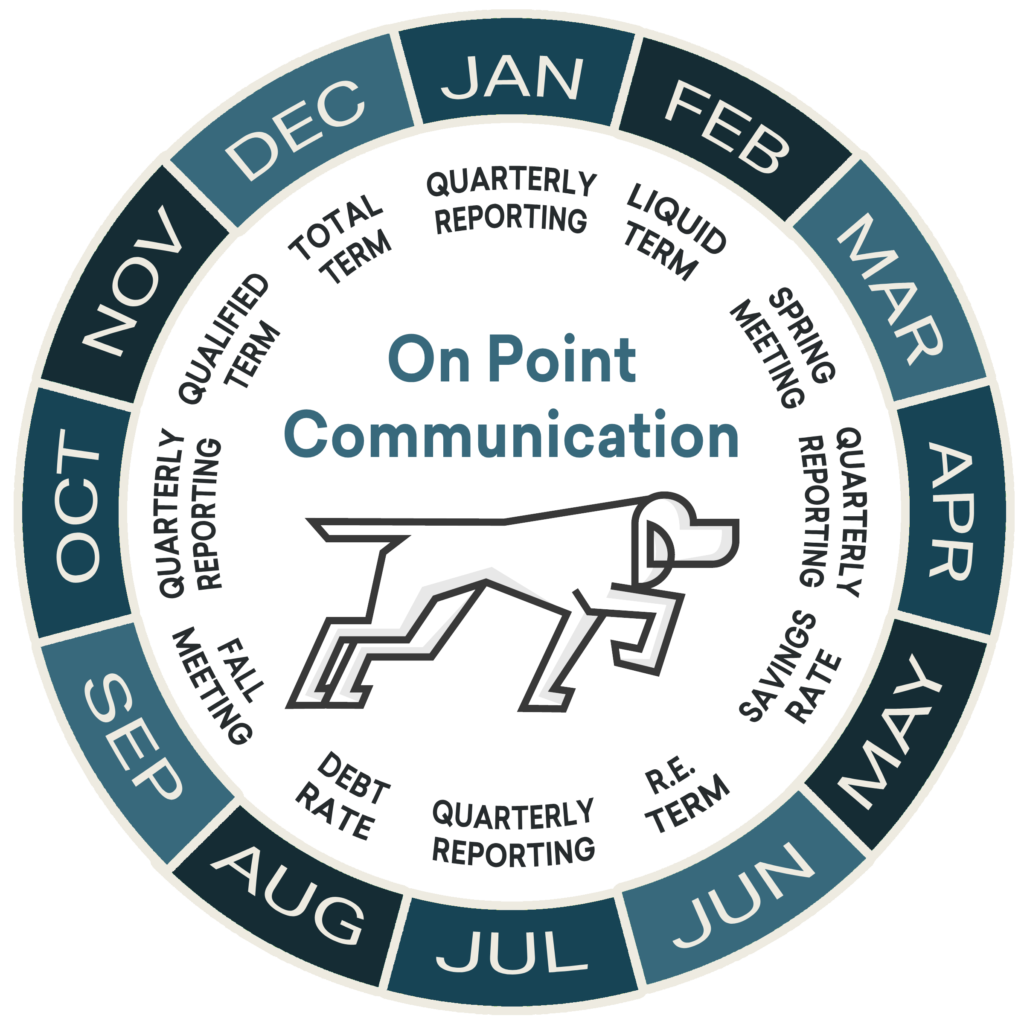

Semi-annual meetings

Spring meeting

Fall meeting

Quarterly updates

Reporting

A relationship with a fee-only fiduciary.

*Fee transparency is super important to us! We aren’t paid through commission, kickback, or other undisclosed revenue sources. We charge a flat fee plus a fee that’s a percentage of the value of the investments we manage. The fees may vary based on client complexity and/or days in a particular billing period—advisory services are provided via Barnhart Wealth Management.

Financial Planning & Investment Management are not offered separately.

Financial

Planning

$100 monthly*

+

Investment

Management

0.10% monthly*

Joining our community? Here’s what to expect.

Pencil us in.

Let’s commence this operation by securing a slot on our schedule.

Initial consult.

In this stage, we play “Financial Pre-Op,” where we do the financial equivalent of a full pre-operative evaluation. We need to understand your fiscal fitness, goals, and concerns. Because just like you wouldn’t want an LMA for that prone case, we want to ensure we’re the right fit for your financial wellbeing.

Your prep.

Before we reconvene, we’ll ask you to install our “Financial Stethoscope” app, aka Elements®. You’ll answer some key questions. Rest assured; it’s easier than passing boards – guaranteed to take under 10 minutes.

The deep dive.

Think of this as your financial “PAT.” We examine your data, double-check your goals, and ensure we’re still on the same page for full clearance.

Our diagnosis.

We wouldn’t dare suggest a treatment plan without a proper assessment and diagnosis first. We’ll confer to make sure our financial prescription is the perfect fit for your goals.

Prescription delivery session.

This is where we become fiscal anesthetists, prescribing a plan that translates financial jargon into plain English. You’ll see the difference we can make, right down to the last penny. We promise, it’ll be as satisfying as pulling off your mask after a 12-hour case!

Don’t miss another update. Subscribe.

Professional Experiences

My journey has taken me from humble beginnings at a boutique financial planning firm to roles at prestigious Fortune 500 companies. After navigating through two corporate mergers, my accomplishments led to the opportunity to mentor other advisors on replicating my financial planning process. Speaking at national conferences and coaching on region-wide calls was a reward in itself. However, the real turning point came when I was overseeing the financial futures of 350 families, with assets eclipsing $850 million.

Despite the fulfilling responsibility, the sheer volume began to overshadow the quality of the client experience. “The Great Pause” of 2020 pushed me to reassess my priorities. I yearned to return to a place where I could truly provide the intimate, personalized experience my clients deserved. Today, as a Certified Financial Planner (CFP®) and Enrolled Agent with the IRS (EA), my focus is on achieving success through my client’s financial goals, not corporate quotas.

I am particularly passionate about assisting CRNAs. This interest stems from my personal life; my wife, herself a dedicated CRNA, has given me profound insights into the unique financial challenges and opportunities that existed on our own road to financial freedom. Like Richard Bach said, “You teach best what you most need to learn.”

It is my firm belief that with complexity should come specialization, no different than in the medical field. The right financial guidance can help CRNAs identify potential land mines and gold mines on their own path to financial independence.

Personal Experiences

I grew up in a rural town in Central Michigan on a small farm across from the local Amish schoolhouse. Math and money were always subjects we talked about growing up, as my father was a high school math teacher. I still remember in 2008, during the global financial crisis, my Dad flipped around the computer monitor and showed me how much his account was down. I’ll never forget the dejected look on his face when he confided that his advisor still had yet to call him.

This experience was remarkably impactful on me and kindled my interest in personal finance. I thought, albeit naively, that I could make an impact based only on ‘what not to do’. Since then, I’ve read anything and everything related to personal finance that I could get my hands on. I believe that wealth management is my calling, and I want to help as many families navigate complex and emotional financial transitions as I can in my career. That responsibility fires me up in the morning and is the source of my passion.