With the market volatility this year, I thought it prudent to share a sparingly used strategy that has the possibility of turning your investment lemons into tax lemonade. As you’ll learn below, this strategy is highly individualized. Between the time-intensity and lack of scalability, many advisory firms do not implement this for their clients. As always, this is not intended as tax or investment advice and should be relied on for informational purposes only. Enjoy!

What is Tax-Loss Harvesting?

One powerful strategy to consider is tax-loss harvesting, a method that reduces your tax liability while optimizing your portfolio. Research in the Journal of Wealth Management highlights how stock-level portfolios, such as those used in direct indexing, provide more consistent loss-harvesting opportunities and higher tax alpha compared to ETFs, often achieving a 1–2% annual tax-management alpha (PM Research).

This strategy involves selling investments at a loss to offset the gains from other investments you’ve sold for a profit. This may seem counterintuitive because you are selling something at a loss for a tax write-off and could miss out on future gains. But not so fast; within the IRS tax code, a workaround allows immediate and future tax benefits without compromising much, if any, future return. While taking a tax write-off for losses may seem analogous to kissing your sister, we will take a look at a way to turn a negative into a positive. This strategy allows you to:

- Offset capital gains – Reducing the taxable gains on successful investments.

- Minimize your overall taxable income – Potentially lower your tax bracket or reduce what you owe in high-tax years.

- Keep your portfolio growing – You can reinvest the harvested losses back into the market in a more tax-efficient way.

For high-earning professionals like CRNAs, tax-loss harvesting may be especially beneficial. With a busy work life and income to manage, a carefully timed tax strategy can help you grow your wealth while staying ahead of your tax obligations.

Common Misconceptions: Tax-Loss Harvesting Isn’t Just for Large Portfolios

A common misconception is that tax-loss harvesting is only beneficial for those with large, complex portfolios. However, this strategy can be useful in a variety of portfolio sizes and income levels. In fact, many CRNAs with smaller portfolios can still benefit by capturing losses and offsetting gains each year. The key is not necessarily portfolio size but rather identifying and acting on opportunities in a way that aligns with your broader financial goals. With thoughtful planning, tax-loss harvesting is a low-risk, effective strategy to enhance your long-term financial health.

Capital Gains and Losses: The Basics

To understand tax-loss harvesting, it’s helpful to know about capital gains and capital losses:

- Capital Gains: If you sell an investment at a higher price than what you paid, the profit is a capital gain, which is typically subject to taxes. The tax rate varies based on how long you held the investment and your income bracket.

- Capital Losses: Conversely, if you sell an investment for less than you paid, that’s a capital loss. These losses can be deducted from your gains, effectively lowering your taxable income. While selling an asset at a loss isn’t fun, the IRS does allow you to write off these losses against any other gains you realized during that year. Also, you can deduct these losses up to $3,000 against your ordinary income. It is a long-term gain or loss if held for over one year. Conversely, it is a short-term gain or loss if held for less than a year. Short-term taxes are calculated based on your ordinary income bracket, while long-term losses are computed using a more favorable rate, as depicted below.

Hypothetical example.

Let’s say you’re a CRNA with a taxable brokerage account. You purchased $20,000 worth of stock, but after a downturn, it’s now worth only $15,000—a paper loss of $5,000. Here’s how tax-loss harvesting could work for you:

- Sell the stock at a $5,000 loss. This sale realizes a capital loss, which can be used to offset any capital gains you might have elsewhere.

- Offsetting Capital Gains: If you’ve sold other investments for a total gain of $4,000, the $5,000 loss would completely offset these gains, resulting in no capital gains tax due.

- Additional Deduction: In most cases, if your losses exceed your gains, you can use up to $3,000 of the excess to offset other income, such as your salary or 1099 income as a CRNA. Assuming you are in the 32% tax bracket, when you go to file your tax return this would save you $960 ($3,000 x 32%).

- Remainder Loss Carryforward: Yet, there is still $17,000 leftover in realized capital losses. These could be used in the future to offset capital gains or $3,000 each year against ordinary income. These losses would carry over indefinitely to future tax years.

By leveraging these losses in a strategic way, you’re effectively turning what would have been a simple investment loss into a tax-saving opportunity. Over time, this strategy could contribute to a healthier, more tax-efficient portfolio.

Why Tax-Loss Harvesting Isn’t Tied to Market Conditions

Tax-loss harvesting doesn’t need to be tied to major market downturns. While many investors think this strategy only applies in “down” markets, in reality, tax-loss harvesting opportunities can arise throughout the year, even during periods of market growth. For example, market dips and corrections, which occur regularly, may provide opportunities to harvest losses without waiting for a bear market. By working with a financial advisor, you can keep an eye on your portfolio and capitalize on tax-loss harvesting opportunities as they arise, regardless of the overall market climate.

What are the Limitations?

While tax-loss harvesting can be beneficial, it’s important to be aware of limitations like the wash-sale rule. This rule prevents you from repurchasing the same or a “substantially identical” investment within 30 days before or after the sale. Violating this rule could disqualify your tax deduction.

This rule makes sense; otherwise, investors would sell all of their positions carrying an unrealized loss at the end of the year to receive the deduction, only to turn around and purchase the same security back immediately. The IRS is wise to this thought process and restricts the repurchase of the security you just sold for 30 days. A lot can happen in those thirty days, most notably missing out on a potential rebound in price. However, the rule states that you can’t purchase the exact same security, but you can buy similar security that is not “substantially identical.” This leaves the door open to a massive tax-planning opportunity.

Another Hypothetical.

To navigate this wash sale limination, you might consider:

- Alternative Investments: Buy similar (but not identical) investments to keep your portfolio balanced and on track with your goals.

- Automated Tools or Advisor Assistance: Tax-loss harvesting can get complex, so many CRNAs choose to work with a financial advisor or automated investment platform to help manage this process efficiently.

Let’s assume you had $1,000,000 invested in $ITOT (the red line on the chart) right before the stock market tanked in March of 2020. Once your million bucks is down 20%, you decide to do some tax-loss harvesting and lock in a capital loss of $200,000 ($1mm x 20%). Once we’ve put that loss on the books, we can’t simply turn around and immediately purchase back your $ITOT, as this would violate the wash-sale rules.

So – we have a decision to make. Do we wait 30 days for the wash-sale period to elapse? This isn’t advantageous as we could miss out on a market rebound. Instead, we could elect to purchase another ETF as a replacement for $ITOT as long as it is not ‘substantially identical.’ Fortunately, for this example, $VTI would serve as a spectacular replacement as it mirrors the $ITOT performance exceptionally well and doesn’t violate the wash-sale rules.

This is because each ETF seeks to track a different broad-based Index. $ITOT tracks the S&P Total Market Index, while $VTI tracks the performance of the CRSP US Total Market Index. Thus, we can take our capital loss of $200,000 and not concede much opportunity cost by not ‘being in the game’ and remain well-positioned and ready to participate in a potential bounceback.

What are the raw numbers in the scenario depicted above?

- January, 2020: $1,000,000 account value, invested in $ITOT.

- March, 2020: $800,000 account value + $200,000 in realized capital losses after selling $ITOT and immediately purchasing $VTI as replacement.

- Tax-time for 2020: You use $3,000 of losses to offset ordinary income when filing your taxes for 2020. Let’s assume your top tax rate is 40% between state, federal, and local taxes. This would save you $1,200 in taxes (3,000 x 40%). Your remaining $197,000 in capital losses will be carried forward to be used to offset ordinary income or capital gains in the future are now free of tax up to $197,000.

- January, 2021: $1,200,00 account value, invested in $VTI

- Takeaway: Get tax-write off without compromising returns? Sign me up. This is what we call in the biz “tax-alpha.” Now, an astute nay-sayer might argue that all we have done is kick the can down the road by realizing a capital loss for a tax benefit today, only to have an unrealized capital gain tax liability tomorrow. While this is true, the adage of a bird in the hand being worth two in the bush certainly applies to tax-loss harvesting. $3,000 of write-offs against ordinary income each year are at a higher rate than you would otherwise pay on long-term capital gains. Plus, you may never realize those future gains as your beneficiaries would receive a step-up in basis. Pending tax legislation proposals may change this, but that is a conversation for another day.

Long-term Tax-alpha Expectations.

The example above is extreme in two regards. It assumes you have your entire portfolio invested in one ETF and showed impeccable timing by taking your capital loss near the market bottom. More realistically, let’s imagine you had a well-diversified portfolio with eggs in many different baskets, each not 100% correlated to the next. You would want a replacement ETF identified for each part of the market (i.e., large-cap growth, large-cap value, long-term bonds, short-term bonds, etc.). This would enable you to realize losses on each part of the market individually rather than the market as a whole. Even further optimizing the tax efficiency of your overall portfolio.

As you might imagine, quite a few academic studies have been published with dense research on this strategy (CFA Institute). This study evaluated the S&P 500 from July 1926 – to June 2018 and found the gross long-term expected annual tax-alpha (assuming 35% for short-term gains & 15% for long-term gains) was 1.08%. After considering wash-sale rules and transition cost(s), the average alpha was 0.69% per year. Or, to say it another way, someone who bought and held the same portfolio but is not engaged in tax-loss harvesting can expect after-tax underperformance of roughly 0.70% compared to someone who takes advantage of such a strategy. The reality is that these benefits will be ‘lumpy,’ meaning, from year to year, the benefits could be higher or lower depending on market conditions.

$1,000,000 invested at 8% for 30 years balloons to $10,062,657

$1,000,000 invested at 7.31% (0.69% less tax-alpha) for 30 years only grows to $8,302,442, or ($1,760,215 less).

Expanding the Example: Using Direct Indexing for Tax-Loss Harvesting

In the previous example, we illustrated how a CRNA could sell a stock at a loss to offset capital gains, using tax-loss harvesting to improve their after-tax return. Typically, this strategy might involve replacing the sold stock with a similar investment, such as an exchange-traded fund (ETF) that tracks a broad index. However, direct indexing provides an alternative that can add even more tax efficiency and customization to the tax-loss harvesting process.

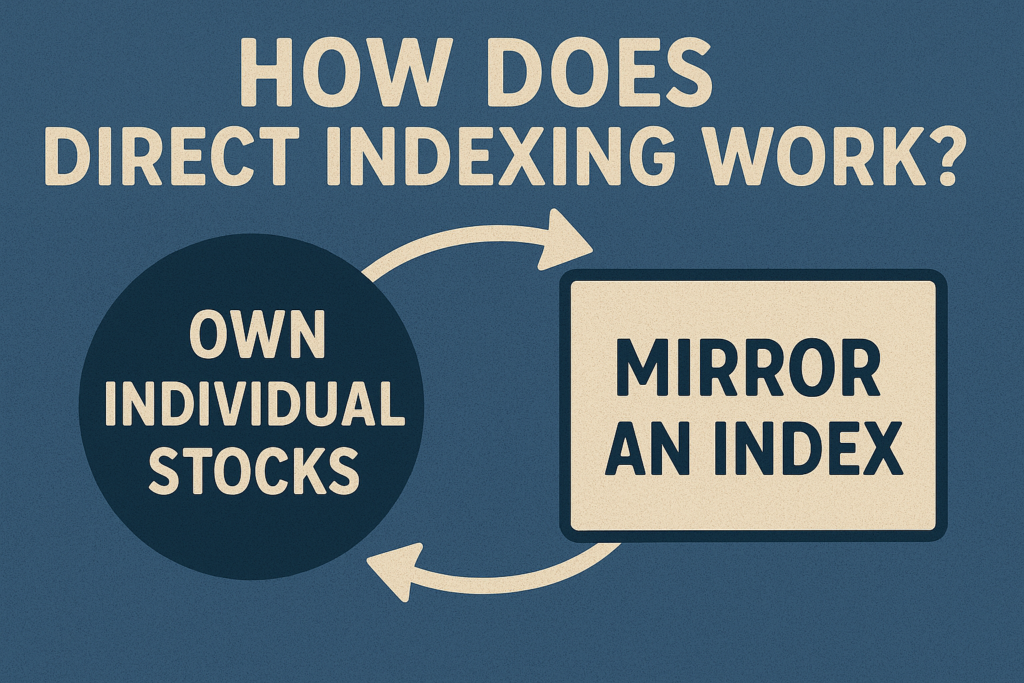

What is Direct Indexing?

Direct indexing allows you to own individual stocks that mirror an index, rather than owning an ETF or mutual fund that tracks it. With direct indexing, you can invest in a customized portfolio that replicates an index, like the S&P 500, but with one key difference: you own the individual stocks, not a single fund. This ownership offers more flexibility for tax-loss harvesting since it lets you capture losses on individual stocks within the index. According to Altruist’s guide on direct indexing, this method enables “granular control” over each security, which can lead to better tax management outcomes over time (Altruist, Direct Indexing: What Advisors Need to Know).

Applying Direct Indexing in Tax-Loss Harvesting

Let’s return to our example, where you, a CRNA, purchased $20,000 worth of a stock index that mirrors the S&P 500. Using direct indexing, instead of selling an ETF as a whole, you could sell specific underperforming stocks within the index individually. This lets you harvest more targeted losses without selling your entire position in the index.

For instance:

- Selective Loss Harvesting: Imagine that, within your indexed portfolio, a few individual stocks have decreased in value. You can sell those specific stocks to realize a loss and use this loss to offset other capital gains, potentially enhancing your tax savings.

- Reinvesting with Customization: After selling the underperforming stocks, you can replace them with different, non-identical stocks within the same sector, thus avoiding wash-sale issues and maintaining your portfolio’s overall balance. This targeted replacement aligns with strategies Altruist describes for optimizing after-tax returns through tax-aware investment choices (Optimizing After Tax Returns).

- Long-Term Compounding of Tax Savings: Over time, these individually harvested losses can create a compounding effect, where the tax savings achieved each year are reinvested, leading to potentially greater long-term portfolio growth.

Is Direct Indexing Right for CRNAs?

Direct indexing offers CRNAs a way to maximize their portfolios’ tax efficiency by targeting individual stock losses for harvesting. As noted in the Wall Street Journal, direct indexing allows for greater customization and tax management compared to ETFs, offering the potential for more consistent loss-harvesting opportunities (WSJ).

Vanguard research highlights how proactive tax-loss harvesting through direct indexing can increase tax alpha by 20 to over 100 basis points (bps) for capital-gains-heavy investors. Frequent harvesting, such as daily screening, produces more consistent results, especially in volatile markets (Vanguard). For CRNAs, this level of customization ensures portfolios align with personal financial goals while maximizing after-tax returns.

Enhanced Tax-Loss Harvesting with Daily Scans

Tax-loss harvesting strategies continue to evolve, and CRNAs can now benefit from cutting-edge advancements like daily loss scanning. Tools such as Altruist’s TaxIQ offer features that identify harvesting opportunities in near real-time, ensuring losses are captured when markets fluctuate. Research highlights how daily tax-loss harvesting can boost tax alpha by ensuring opportunities are not missed due to timing mismatches during quarterly or annual reviews (Altruist).

This approach provides an edge in volatile markets, maximizing efficiency and enhancing long-term wealth growth.

Final Thoughts: Is Tax-Loss Harvesting Right for CRNAs?

For CRNAs, tax-loss harvesting can offer a significant tax benefit, especially when managed within a long-term investment strategy. Not only can it help you reduce your tax obligations on a year-to-year basis, but it can also contribute to the growth of your after-tax wealth over time.

When someone tells me I should be happy because I lost less than the market, it reminds me of what the grocery cashier says when I buy groceries: ‘Because you’re a member of our shoppers’ club, you just saved $4.25.’ No, I didn’t. I just spent $87. However, not giving up much, if anything (performance), to get something potentially greater than what you gave up (tax benefits) is a smart choice. Any taxable account that does not take advantage of this strategy abhors logic and reason.

Remember, you’ve got to deal with the rain to get the rainbow. In both markets and in life, if there are no problems, then there is no progress. So when crises and disasters strike, don’t waste them. Tax-loss harvesting is a strategy that can make market turbulence slightly more palatable, and in a way, possibly turn lemons into lemonade.

If you’re interested in exploring tax-loss harvesting, you may want to speak with a financial advisor who can tailor this strategy to your unique goals and financial situation. By taking advantage of tax-loss harvesting, you could potentially improve your financial health while focusing on what you do best—providing exceptional care in your CRNA practice.

“The obstacle in the path becomes the path. Never forget, within every obstacle is an opportunity to improve our condition.” — Ryan Holiday