The Hidden Gem of Converting Your 403(b) to a Roth IRA While in School

As a student registered nurse anesthetist (SRNA), you’ve embarked on a rewarding and challenging journey. With long hours and a seemingly never-ending workload, the last thing on your mind might be your financial future or tax strategies. But what if I told you there’s a hidden gem you may have overlooked in your quest for financial stability?

Picture this: a tax strategy that allows you to convert your old 403(b) to a Roth IRA while you’re still in school, potentially saving you upwards of 6-figures in taxes over the course of your lifetime. Sound too good to be true? Buckle up, and let’s dive into this potentially game-changing move for your financial future.

“If opportunity doesn’t knock, build a door.”

– Milton Berle

A Little Background: 403(b) and Roth IRA

Before we dive headfirst into this tax strategy, it’s essential to have a fundamental understanding of 403(b) plans and Roth IRAs. A 403(b) plan is a tax-advantaged retirement plan offered by certain nonprofit organizations, public education institutions, and hospitals. Much like the more widely known 401(k), a 403(b) allows employees to make pre-tax contributions, with earnings and gains growing tax-deferred until withdrawal. Odds are, you’ve got an old 403(b) that you contributed to while getting your ICU experience before applying to school.

On the other hand, a Roth IRA is a retirement account that allows you to contribute after-tax dollars. While there’s no immediate tax break for contributions, the real magic happens when you withdraw funds during retirement. Roth IRA withdrawals are tax-free, allowing you to enjoy your golden years without the taxman knocking on your door.

Benefits of Converting Your 403(b) to a Roth IRA

Remember that wise old proverb, “a penny saved is a penny earned”? When it comes to taxes, this age-old wisdom rings truer than ever. Converting your 403(b) to a Roth IRA may seem like an unconventional move while you’re in school, but the benefits can be substantial for SRNAs.

The Golden Opportunity: Tax Bracket Advantage

During your time as an SRNA, you’re likely in a lower tax bracket due to decreased income while in school. This presents a golden opportunity to convert your 403(b) to a Roth IRA at a potentially lower tax rate than you would pay in your future career as a nurse anesthetist. The idea here is to pay taxes now at a lower rate, and then enjoy tax-free withdrawals in retirement when your income is likely higher.

“Save your money. You’re going to need twice as much money in your old age as you think.”

– Michael Caine

But Wait, There’s More: Flexibility and Growth Potential

Roth IRAs come with an added layer of flexibility compared to traditional retirement accounts like the 403(b). Contributions (not earnings) can be withdrawn tax-free and penalty-free at any time, making it an appealing option for emergency funds or other financial goals.

Additionally, the power of tax-free growth cannot be overstated. By converting to a Roth IRA, you harness the potential for years of tax-free growth, putting you in an enviable position when it’s time to enjoy your hard-earned retirement.

A Quick Example

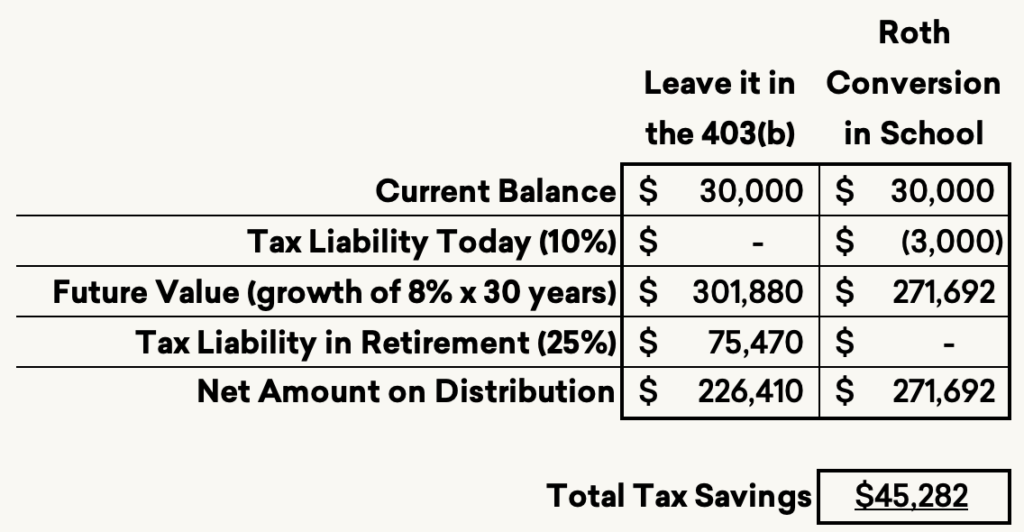

Suppose an SRNA has accumulated $30,000 in a previous 403(b) account. She has prudently set aside a substantial emergency fund to cover her living expenses while in school. If she takes no action, her income during her studies would essentially be in the red, with no incoming salary and her standard federal tax deduction going unused.

What she could look to do is convert all $30,000 in the 403(b) from a pre-tax account to an after-tax account (Roth IRA). What does this mean? Well, she’s going to owe the tax man. How much? Doing some “back-of-the-napkin math” between state and federal, for our example, let’s assume she would owe around $3,000.

Now, let’s imagine that she didn’t touch her 403(b) and it increased by 8% every year for the next 30 years. This would balloon to a bigger number than if she had done the conversion (as you can see in our example). She doesn’t have to pay the $3,000 tax upfront, so because she starts with a larger amount, the account grows more compared to if she did a Roth Conversion (we’re assuming here that she took out the taxes during the conversion, which ideally we wouldn’t do so more money could grow in the Roth, but that’s a side point). Remember though – the amount in the Roth IRA, while lower, is tax-free.

She will likely be in a higher tax bracket in retirement compared to when she was a student and didn’t have an income. Let’s guess she’d be taxed at 25% at that time. You can see from our example that the total tax savings could be pretty significant.

A Word of Caution: Essential Considerations

While converting your 403(b) to a Roth IRA can be a smart financial move, there are essential factors to consider. Let’s explore these considerations to ensure you make an informed decision.

Tax Implications

When you convert your 403(b) to a Roth IRA, you will need to pay taxes on the amount converted. This tax bill can be significant, so it’s essential to consult with a qualified tax advisor to understand the implications fully. They can help you determine the optimal conversion amount to minimize tax liability.

Time Horizon

The decision to convert should also consider your time horizon. Conversions made early in your career offer the most significant advantage due to the potential for long-term tax-free growth. However, conversions later in your career may still be beneficial, depending on your unique circumstances.

Funding the Tax Bill

Paying the tax bill resulting from a Roth conversion is another crucial consideration. It is recommended to pay the taxes with cash from outside your retirement accounts. Using funds from your 403(b) to cover the tax bill would defeat the purpose of the conversion, as those funds would no longer benefit from tax-free growth.

The Fine Print: How to Make the Conversion

Now that we’ve covered the potential benefits of this tax strategy let’s break down the process.

Consult a Financial Advisor

Before making any decisions, it’s essential to consult a qualified financial advisor who specializes in tax planning and retirement strategies. They can provide personalized guidance based on your specific financial situation and goals.

Money Movement

First, you’ll need to open a Roth IRA & Rollover IRA with a financial institution of your choice. Next, you’ll request a direct rollover from your old 403(b) plan to your new Rollover. It’s crucial to ensure the funds are directly transferred from the 403(b) to the Rollover IRA to avoid any penalties or complications.

Determine Conversion Amount

While converting your 403(b) to a Roth IRA while in school can be a savvy tax strategy, it’s not a one-size-fits-all solution. Timing and amount to convert are everything, and careful consideration must be given to your unique financial situation.

Consider your current tax bracket and liquidity, projected future income, and future retirement lifestyle. You should also be aware of any potential impact on financial aid eligibility when converting your 403(b). Consult with a trusted financial advisor to discuss the pros and cons of this strategy for your particular circumstances.

Paying the Taxes

As mentioned earlier, it is recommended to pay the taxes resulting from the conversion with cash from outside your retirement accounts. This ensures that your converted funds can continue to grow tax-free.

Reporting the Conversion

When you execute a Roth conversion, it’s essential to report it accurately on your tax return. Your financial advisor or tax professional can guide you through the process and ensure compliance with IRS regulations.

“The art is not in making money but in keeping it.”

– Proverb

Final Thoughts: Converting Your 403(b) to a Roth IRA as an SRNA

The road to becoming a nurse anesthetist can be long and arduous, but taking the time to plan your financial future now can pay off immensely down the road. Converting your 403(b) to a Roth IRA while in school can be a powerful tax strategy, offering lower taxes today and tax-free income in retirement. But remember, every individual’s financial situation is different, so do your due diligence and consult with a financial professional before making any decisions.

By keeping an eye on your financial future and embracing smart strategies like this Roth IRA conversion, you’ll set yourself up for success in the long run. After all, it’s the diligent planner who will laugh last and loudest.

My job is to provide advice that puts my clients in the best position to be successful. I aim to provide you with the financial guidance you need to navigate the complexities of wealth management. The choice is yours, and the opportunity awaits. Carpe diem!