Imagine trying to keep your footing on a tightrope as you balance your net worth on your shoulders. Teetering too far in any direction could send you toppling. Understanding your Real Estate Term (Rt) Score is crucial to maintaining this delicate balance. Just like monitoring your heart rate during a workout, keeping a close eye on this financial vital sign ensures you’re staying on track and maintaining a healthy mix of assets. In this post, we’ll explore how the Rt Score is calculated, what it signifies, and why it matters, all while shedding light on the nuances of personal use and investment real estate.

🏠 Crunching the Numbers: The Real Estate Term Score

The Real Estate Term (Rt) is a financial metric that indicates the number of years you could live on your current real estate equity, assuming no asset growth or decline. Real estate equity includes the value of any homes or investment properties minus related debts. In other words, it’s a way to measure how much of your net worth is tied up in real estate and helps you understand if you have the right mix of assets.

📚 Breaking It Down: Calculating Your Rt

An Example of Real Estate Term Calculation

Let’s say you have a $500,000 home with a $300,000 mortgage and spend $100,000 annually.

Your Real Estate Term would be calculated as follows:

Real Estate Equity: $500,000 – $300,000 = $200,000

Annual Living Expenses: $100,000

Real Estate Term: $200,000 / $100,000 = 2.0

A high Rt Score indicates a large portion of your net worth is tied to real estate, while a low score means real estate makes up a smaller fraction.

🔑 The Importance of Rt

Real estate has long been considered a reliable way to achieve financial independence. However, many people fail to grasp the true implications of owning and maintaining physical real estate on their spending and overall financial health. As a significant part of your net worth, real estate is a crucial consideration when determining your readiness for financial independence. Additionally, understanding the allocation of your real estate assets (i.e., personal-use property versus investment property) will have significant implications on the success of your retirement plan.

⚖️ The Fine Line: Personal Use vs. Investment

There’s more to the real estate game than meets the eye. When considering your Rt Score, distinguishing between personal use and investment real estate is vital.

Personal use real estate encompasses your primary residence and vacation homes. It’s a lifestyle asset that, while valuable, may not generate income or appreciate rapidly. On the other hand, investment real estate comprises rental properties, commercial properties, and land held for development. This type of real estate is acquired primarily for financial gain and capital appreciation.

As you ponder your Rt Score, ask yourself:

- Are my properties helping me build wealth or draining my resources?

- Do I have the right balance of personal use and investment real estate?

- Should I rely too heavily on real estate and diversify my assets?

The answers to these questions will guide you in making informed decisions about your financial future.

👥 The Tale of Two Homeowners

Let’s consider the story of two homeowners, Alice and Bob, each with a net worth of $1 million. Alice owns a primary residence worth $400,000; Bob has a primary residence worth $250,000 and an investment property valued at $150,000.

Their Rt Scores are as follows:

Alice’s Rt Score: ($400,000 / $1,000,000) * 100 = 40%

Bob’s Rt Score: ($400,000 / $1,000,000) * 100 = 40%

Despite having the same Rt Score, Alice and Bob have different real estate portfolios, risk exposure, and potential for appreciation. It’s crucial to dig deeper into personal use and investment real estate nuances to make informed decisions.

🎯 Why Your Real Estate Term Score Matters

Your Rt Score is more than just a number. It’s an essential indicator that reveals whether you have an optimal mix of assets and whether you have too much or too little net worth concentrated in real estate. An excessively high score might signal overexposure to real estate risks, such as market fluctuations and property damage. Conversely, a low score could mean you’re missing out on the potential rewards of real estate investments.

To evaluate whether your Real Estate Term is appropriate or if improvements are needed, you can follow these three steps:

- Score Accuracy: Ensure the accuracy of the Real Estate Term inputs by having an up-to-date net worth statement and an accurate spending number. To ensure accuracy, reference the Burn Rate for spending and Total Term for net worth assessment guides.

- Score Assessment: It’s essential to understand your Real Estate Term in the context of your total asset mix. Generally, a heavier allocation toward real estate assets means less flexibility in your retirement strategies. Age also correlates directly with your Real Estate Term because your equity will grow as you pay down your real estate debts. Be sure to know the composition of your real estate holdings and the level of true liquidity behind your Total Term score.

- Score Improvement: To make improvements, consider the following questions for each type of property:

- For personal-use real estate: How much of your Real Estate Term is composed of your primary residence? Exclude the Real Estate Term from Total Term when assessing retirement readiness if it primarily comprises the primary residence.

- For investment real estate: Should you invest in real estate? What are your real estate goals, and what type of property should you invest in? Do you understand the implications of investing in real estate? Considering your total asset mix, do you need to increase liquidity before investing in additional real estate?

📚 A Case Study

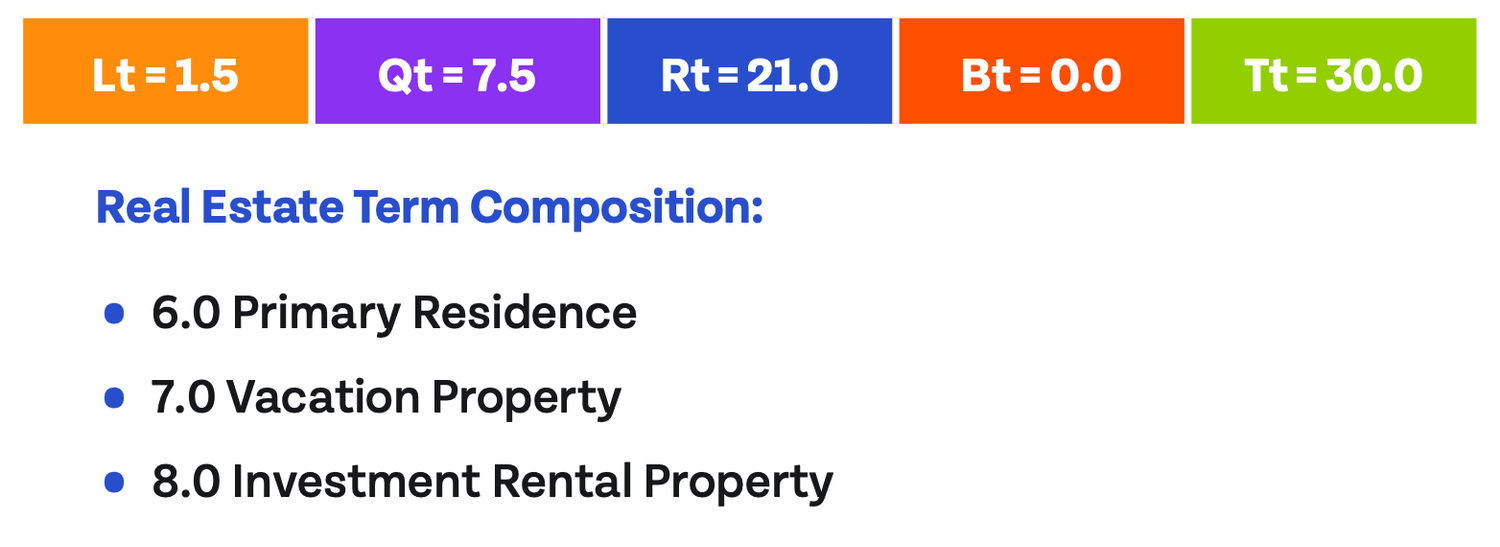

Let’s apply these principles to clients in their mid-50s with the information depicted.

Steps to Improvement

- Determine Score Appropriateness: Review the client’s asset mix and determine that their allocation toward real estate is too high for their current needs, with most of their real estate composition in personal-use properties.

- Identify Improvements: After discussing the objectives of each property, you learn that the client does not enjoy their vacation property and would be happy to rent it out or sell it to increase their total liquidity.

Potential Outcomes

- If they sell the property, their Liquid Term score will improve, and their spending will decrease due to no more maintenance expenses. This action will result in a more balanced asset allocation.

- If they keep and rent the property, they’re shifting their Real Estate Term allocation from personal use to investment property, justifying the high real estate exposure. Their Liquid Term and spending will remain the same, but they will have a source of rental income.

In conclusion, understanding your Real Estate Term score can help you determine if you have the right mix of assets and if you have too much or too little net worth concentrated in real estate. You can improve your financial situation and achieve a more balanced asset allocation by assessing your personal use and investment real estate holdings. By using the Real Estate Term as a vital financial sign, you’ll be better equipped to make informed decisions regarding your real estate investments and overall financial health.

🐢 Slow and Steady: Winning the Real Estate Race

As the old adage goes, slow and steady wins the race. Keeping a close watch on your Real Estate Term Score and maintaining the right balance between personal use and investment real estate can help ensure you’re on the path to financial success. Just as fitness enthusiast monitors their heart rate to optimize their workout, keeping your finger on the pulse of the Real Estate Term Score will ensure that you stay on track and in tip-top financial shape. So go ahead, calculate your Rt Score, and use this powerful tool to build a solid financial future, one step at a time.

As always – stay on point!