The Setup: Perfect Performance, Terrible Timing

There’s a legendary piece over at Alpha Architect titled Even God Would Get Fired as an Active Investor. Catchy title. Disturbingly true.

Here’s the short version: researchers built a fictional portfolio where “God”—with perfect foresight—picked only the best-performing stocks over each five-year window from 1927 to 2016. Every rebalance, God bought the future top 10% of stocks. In a long-short version, He also shorted the worst 10%.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. In fact, these returns are EXPLICITLY IMPOSSIBLE TO ACHIEVE. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Note: these results were updated on 6/14/2017. [Source]

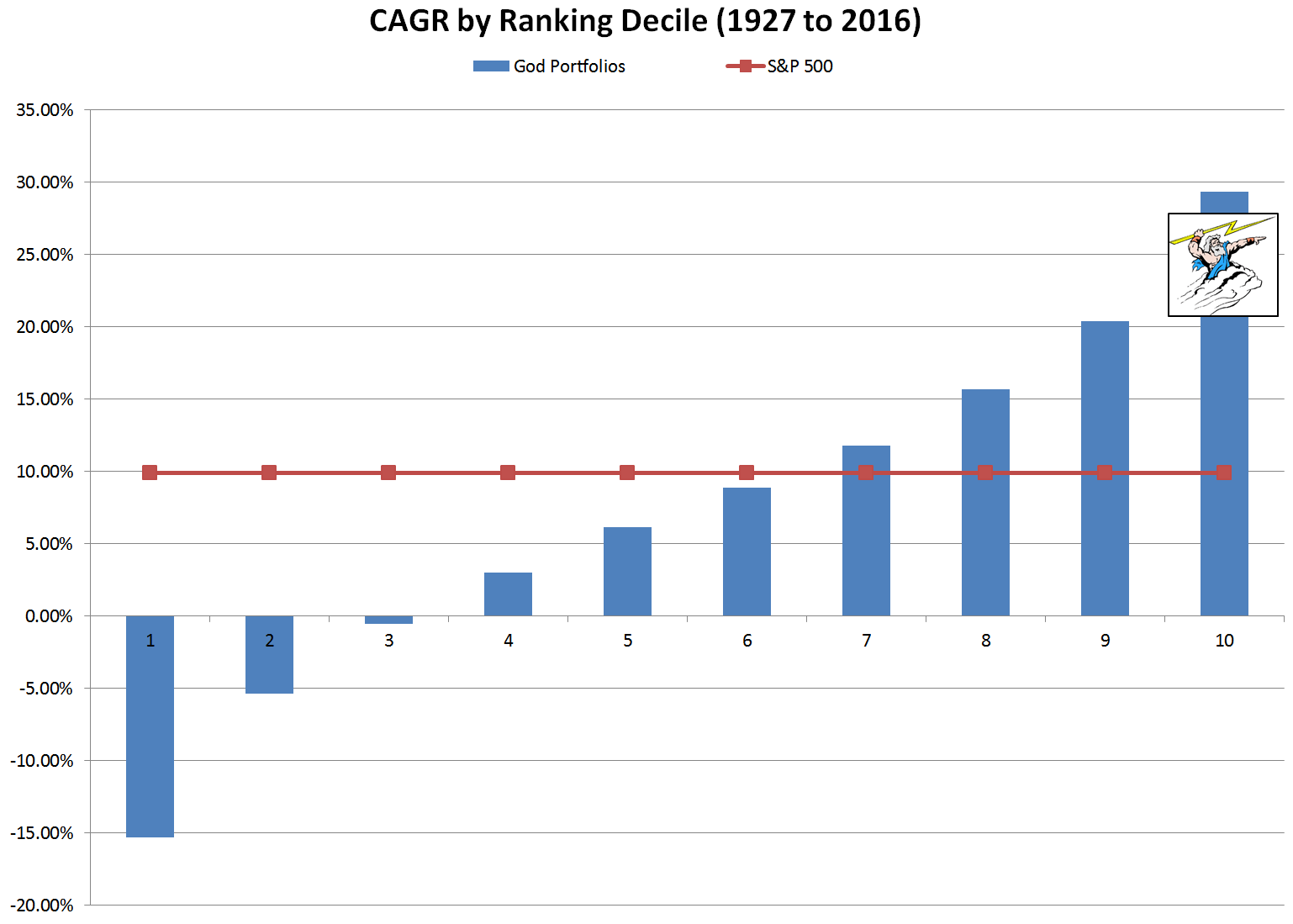

- The long-only “God portfolio” returned 29% annually

- The long-short version returned an eye-popping 39–46% annually

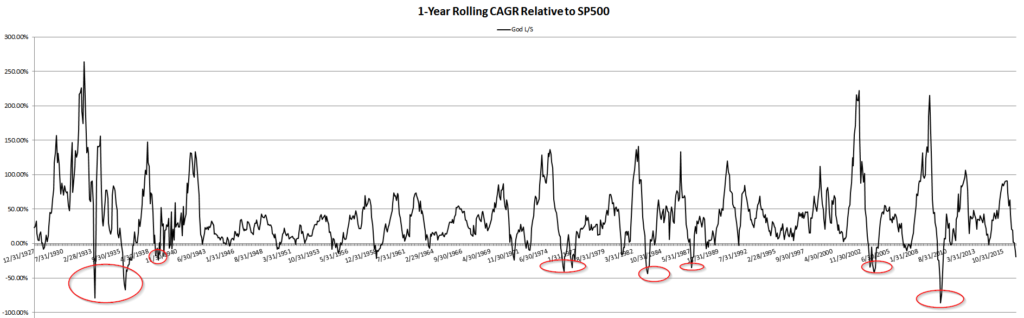

Why Most People Would Still Fire God

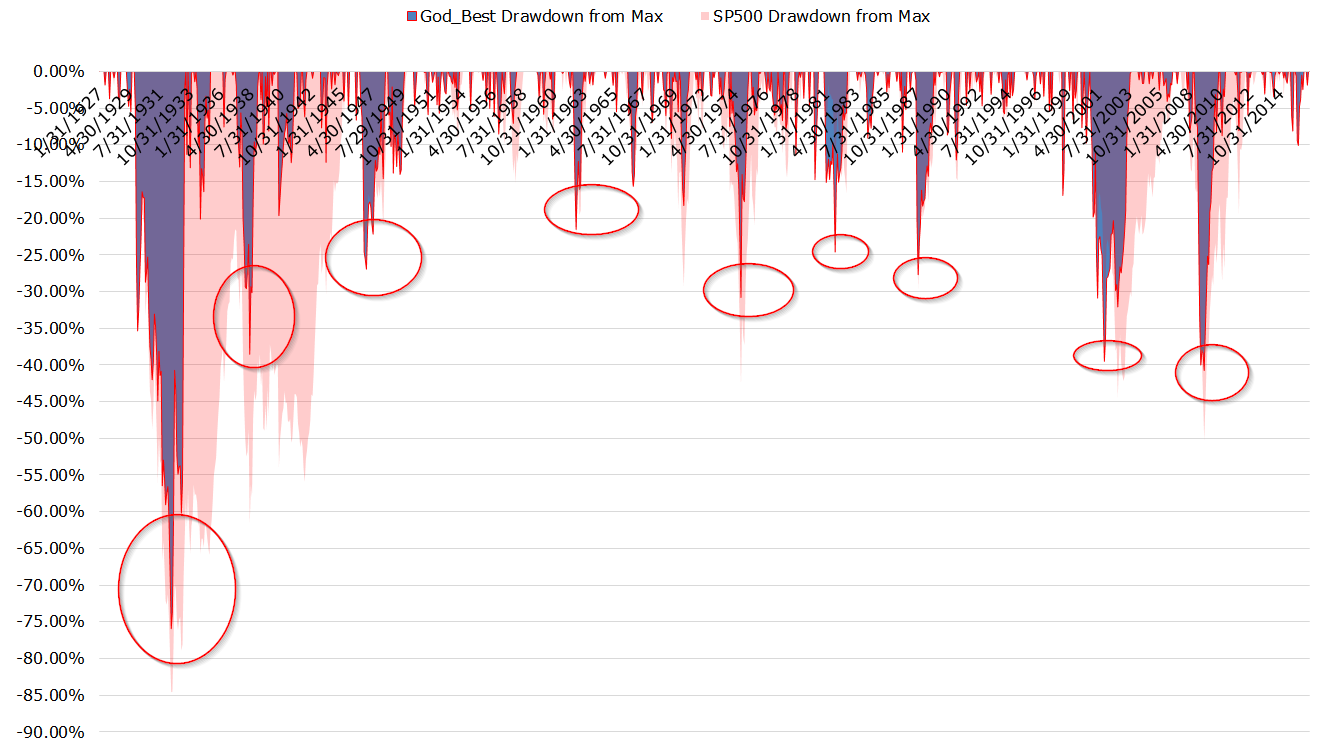

Even with perfect picks, the ride was a nightmare:

- Long-only drawdown: –76%

- Routine 20–40% dips, even when “right”

- Long-short strategy still saw –70%+ drawdowns

How ’bout them drawdowns? Even God couldn’t survive the emotional whip of market volatility. And He had 100% accuracy.

Why This Matters (Especially If You’re a CRNA)

If you’re a CRNA, you’ve got a high-stress, high-stakes job. You don’t have time to check your portfolio hourly, and honestly, you shouldn’t. The Alpha Architect study proves what most people get wrong: how you invest matters less than how long you can stay invested.

If your strategy can’t survive a little underperformance or volatility—neither can you. That’s why we build plans that stick. Ones you can sleep with.

Want to understand how we align your investments with real-world behavior? Check out:

- Why the Games Should Stop With GameStop

- Direct Indexing for High-Income Investors

- Tax-Loss Harvesting for CRNAs: Turn Your Investment Lemons Into Tax Lemonade

The Big Lesson: Strategy Is Useless Without Staying Power

This article isn’t really about divine market timing. It’s about how even perfect investors would fail under imperfect client expectations.

If you’re constantly tweaking strategies, switching funds, or bailing when things get rough—you’re playing a game rigged for failure. That’s why we focus on:

- Owning the right things, in the right accounts

- Owning tax-efficient investments

- Keeping costs low

- Risk levels matched to your behavior, not a generic survey

And above all, a plan you can actually follow. Even in a storm.

The On Point CRNA Takeaway (i.e., What CRNAs Can Learn from the God Portfolio)

If even a perfect portfolio gets fired because of temporary underperformance, what chance does your DIY stock-picking app have?

This is why I work so closely with CRNAs: to make sure your investment strategy isn’t just good, but durable. Because consistency is what builds wealth. Not clairvoyance.

Read the full article here if you want your mind blown (or your ego humbled).

Or better yet, schedule a call and let’s build something you’ll actually stick with.

Frequently Asked Questions

Why is it so hard to stay invested when things go south?

Because your brain isn’t wired for it. When the market drops, even a little, your instincts kick in. Fight or flight. Doesn’t matter how smart your plan is if you abandon it mid-air. The God portfolio dropped 76% and still crushed the market long term. Most folks wouldn’t have made it past the first dip. Staying invested is the game. Not guessing right.

What’s the biggest mistake I see CRNAs make with investing?

Waiting. Waiting for the market to calm down. Waiting for a “better time.” Waiting until they feel ready. Spoiler alert: the market doesn’t send invites. And nobody ever feels ready. The opportunity cost of sitting in cash while your future self racks up compound interest? Brutal.

Is active investing worth it if I want better returns?

Not if you’re working 40+ hours in an OR. Active investing is expensive, time-consuming, and usually underperforms. Even with perfect information, the Alpha Architect study showed you’d still be down 70% at times. That’s not a strategy, that’s a blood pressure spike. Most CRNAs are better off with something low-cost, diversified, and repeatable. You want a portfolio that works while you work.

I use a robo-advisor—why would I need more than that?

Because investing is only one slice of the pie. Robo-advisors don’t talk to you about tax planning, student loans, asset location, or how to manage risk when you’re thinking about changing contracts. They don’t keep you from making a dumb move when things get scary. We do.

I’ve been sitting in cash. How should I get started?

First off, stop beating yourself up. The best time to start was yesterday. The second-best time is before you read another article about “market uncertainty.” We help CRNAs ease into investing with globally diversified ETFs, behavior-based risk targets, and a plan that works in real life. No all-in, no timing the bottom, just smart, steady moves.

Disclaimer:

Barnhart Wealth Management (DBA On Point CRNA) is a registered investment adviser offering services in Michigan and other jurisdictions exempt from registration. This content is for informational purposes only and does not constitute advisory services or sales of securities. All views, expressions, and opinions in this communication are subject to change. Investing involves risk, including loss of principal. Comments and recognitions do not guarantee future results.