When your CPA and your advisor don’t compare notes, dollars slip through the cracks. Watch the short case-study video below, then use the links to go deeper on each move.

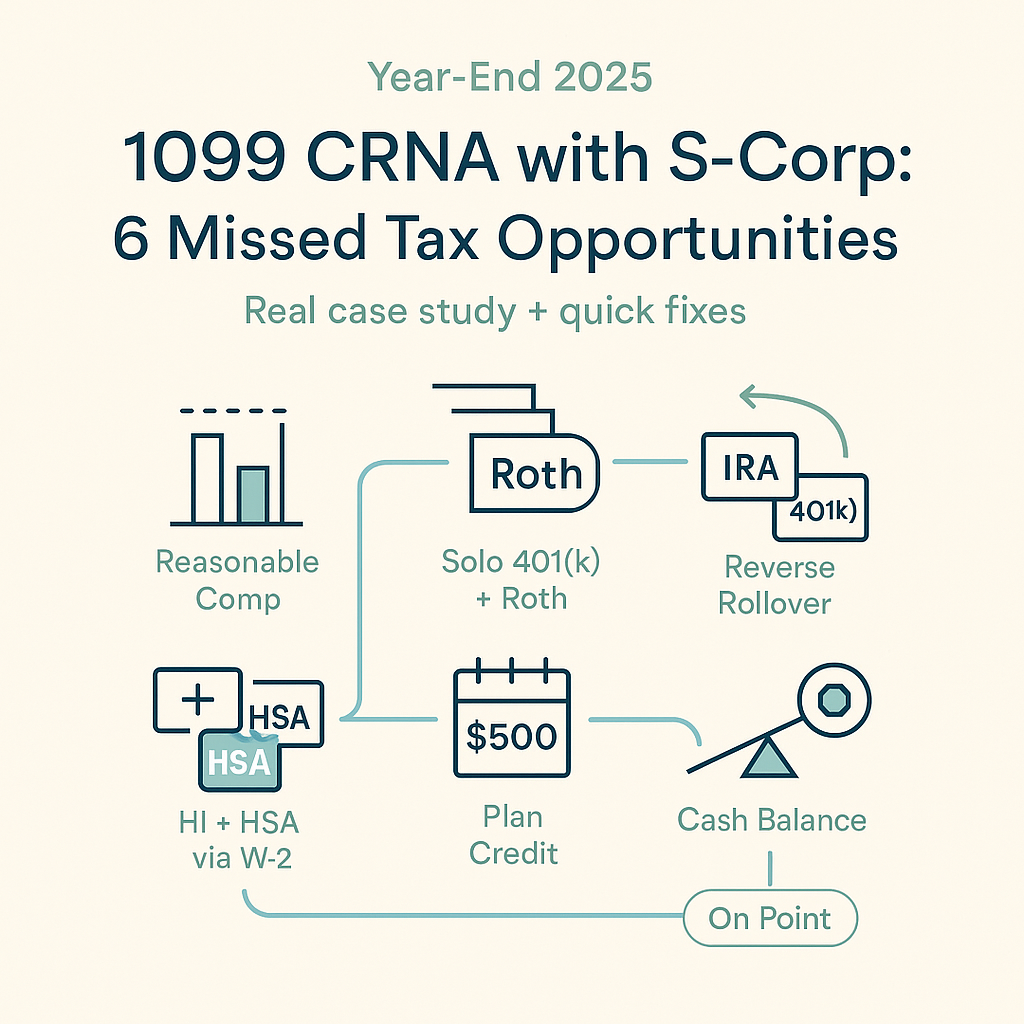

The six fixes (with deeper dives)

- Right-size “reasonable compensation.” If you’re already past the Social Security wage base, paying extra FICA for no benefit is… not optimal. Start here: Sole Proprietor vs. S-Corp for 1099 CRNAs.

- Rebuild the Solo 401(k). Employee deferral + 25% profit share + after-tax contributions with in-plan Roth conversions (aka “mega backdoor”). Case study + mechanics: CRNA 1099 Case Study: Solo 401(k) + Mega-Backdoor.

- Reverse rollover the old IRA. Move pre-tax IRA dollars into the Solo 401(k) so the regular backdoor Roth works cleanly (no pro-rata mess). How-to: Reverse Rollover to a Solo 401(k).

- Run health insurance + HSA through payroll (for >2% S-Corp owners). Done right, it’s FICA-smart. Walkthrough: Health Insurance & HSA via Your S-Corp.

- Don’t miss plan credits. Some Solo 401(k) designs can qualify you for small plan credits (e.g., auto-enrollment). For a broad stack of tax levers, see the CRNA Tax Strategy Playbook.

- Consider a cash balance plan. If your savings target is aggressive and cash flow supports it, a CB plan can be the “second engine.” For broader year-ahead context, see OBBBA: What It Means for CRNAs.

Also helpful

- CRNA Case Study: 1099 vs. W-2 — Same Hours, Different Dollars

- 1099 vs W-2 for CRNAs: How to Compare

- See more articles in Learn

What to do next

1) Watch the video above. That’s the main event.

2) Want your setup pressure-tested before 12/31? Book a quick fit call on our Start Here page.

Education only. Not tax advice. Talk with your tax professional about your specific situation.