🤔 Understanding Liquid Term in Today’s Financial Landscape

In a world where financial uncertainty can feel like a constant, understanding and managing your Liquid Term (Lt) becomes critical. Think of it as your financial security score—it tells you how long your liquid assets can sustain your current lifestyle.

🔗 Related: How to Build an Emergency Fund That Works for You

🫣 Breaking Down Liquid Term (Lt)

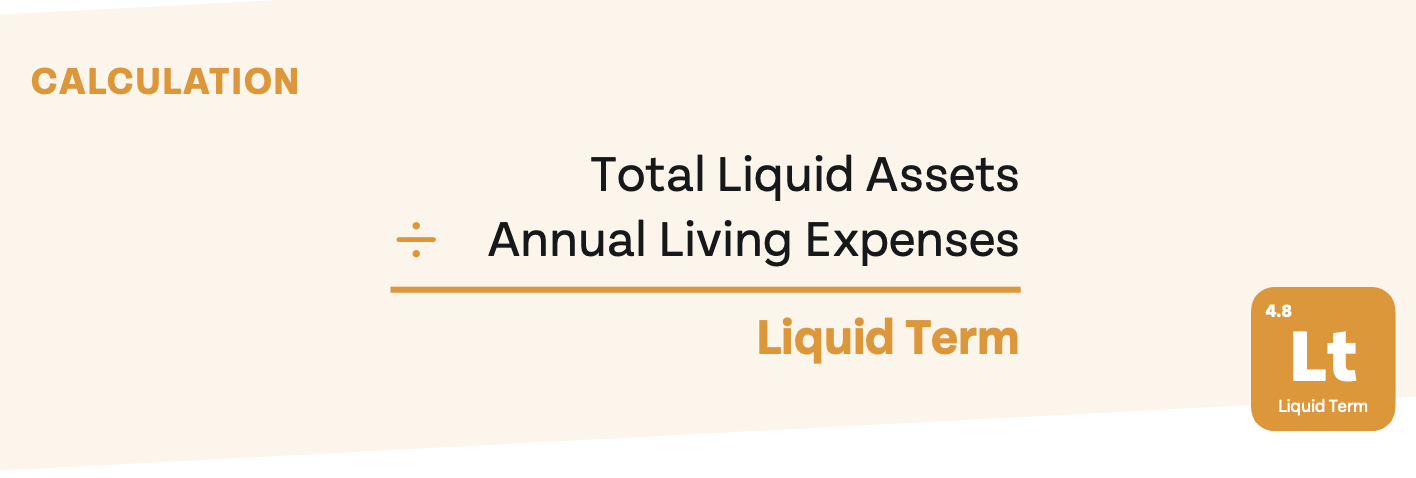

What Is Liquid Term?

A straightforward calculation: 💡 Lt = Total Liquid Assets ÷ Annual Living Expenses

This metric provides a clear picture of how long you could maintain your lifestyle solely based on liquid assets.

Why Your Liquid Term Score Matters

Your Lt score is a real-time snapshot of your financial health. It helps you assess:

✅ Your ability to handle unexpected financial challenges

✅ How long you can sustain your lifestyle without new income

✅ Whether you’re prepared for a financial downturn

🔗 External Source: Investopedia’s Guide to Liquid Assets

🧮 Calculate Your Liquid Term (Lt):

- Gather Your Numbers: Start by rounding up all your liquid assets. This includes cash, stocks, bonds, and other assets that can be quickly converted into cash.

- Annual Living Expenses: Now, it’s time to get a grip on your yearly expenses. This isn’t just your Netflix subscription and groceries; think about everything from utilities to those sneaky little expenses that add up.

⚖️ Score Assessment:

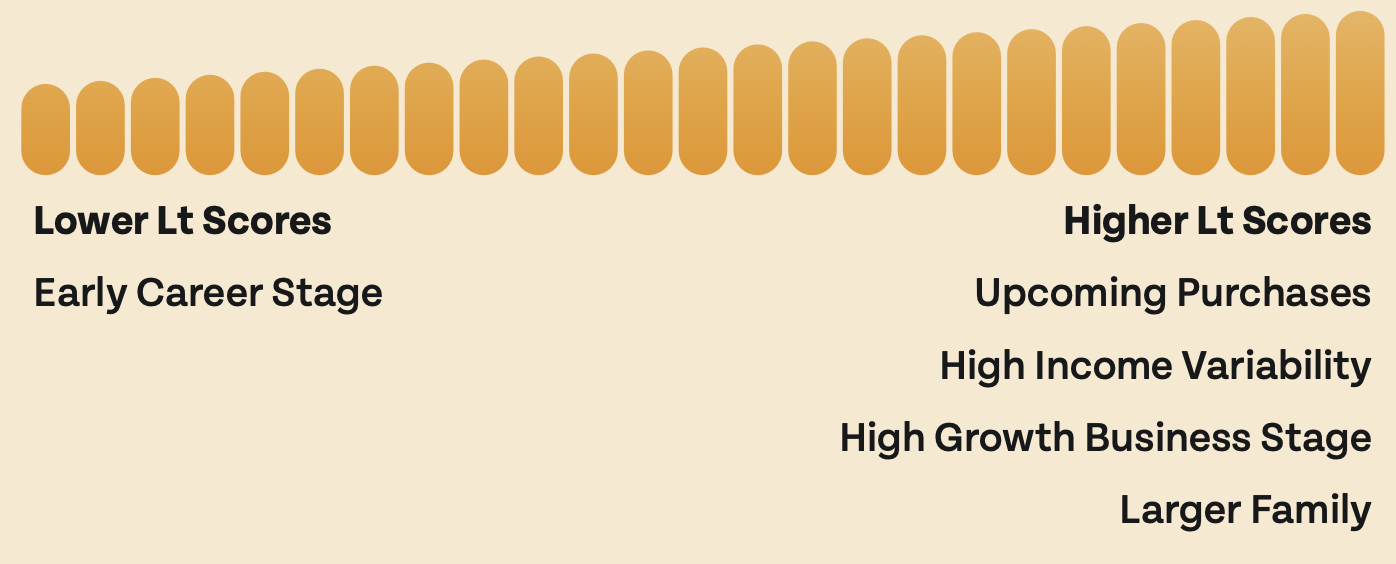

Interpreting Lt: Once you have your Lt, what does it tell you? If it’s a high number, you’re sitting pretty like someone who brought an umbrella to a surprise rainstorm. A lower number? It’s time to rethink things in case of a rainy day.

💪 How to Improve Your Liquid Term

Boost Your Assets

✔️ Increase savings contributions

✔️ Adjust your investment strategy to include more liquid assets

✔️ Diversify income streams (side hustle, dividends, etc.)

🔗 External Source: NerdWallet’s Guide to Building Wealth

Trim Your Expenses

✔️ Reduce discretionary spending (eating out, subscriptions, impulse buys)

✔️ Optimize recurring costs (insurance, phone plans, streaming services)

✔️ Identify unnecessary fees and eliminate them

🔗 Related: How to Reduce Living Expenses Without Sacrificing Quality

📚 Case Study: Strategic Liquid Term Management for a Growing Family

In the realm of financial planning, theory often meets reality in the form of complex life situations. Let’s explore a case study that exemplifies this intersection and demonstrates the practical application of the Liquid Term (Lt) concept.

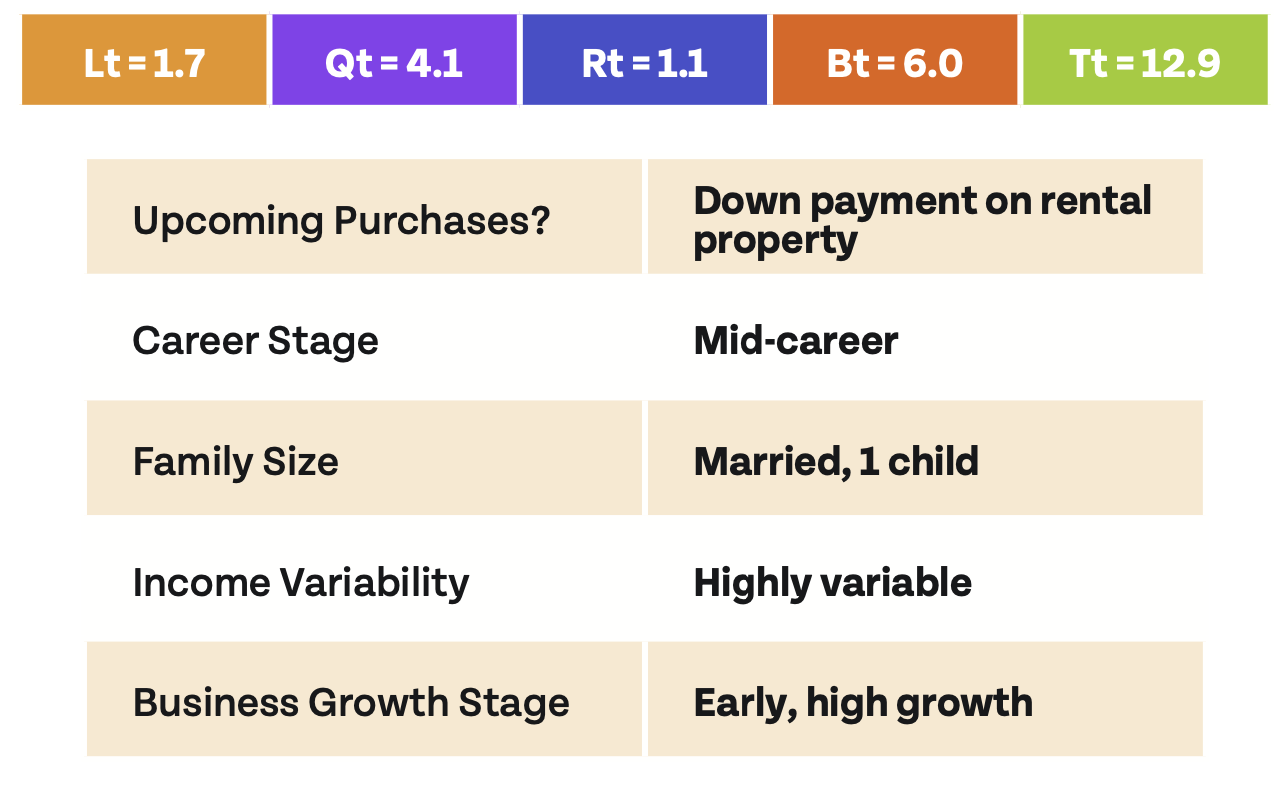

The Scenario: Meet the Johnsons – a mid-career couple with one child, facing the typical challenges and opportunities of a growing family. They’re considering a major financial move: making a down payment on a rental property. Their current financial snapshot reveals:

Their income is highly variable, and they’re in the early, high-growth stage of their business.

Step 1 – Score Assessment: The initial assessment of the Johnsons’ situation suggests a relatively healthy financial position, given their small family size and Lt of 1.7. However, the upcoming property investment, combined with their variable income and business growth stage, indicates a potential liquidity crunch. Their current Lt score may not sufficiently support their near-term financial needs.

Step 2 – Identify Improvements: To address this, two primary areas are identified for improvement:

- Enhancing Savings Rate: Increasing their savings rate becomes a priority. This step focuses on boosting their liquid assets, providing a cushion for both the property investment and any unexpected expenses due to income variability.

- Building Cash Reserves: Strengthening their cash position, especially in after-tax accounts like savings and brokerage, is crucial. This approach not only enhances their Lt but also ensures they have readily accessible funds for immediate needs and opportunities.

Example Calculation: For a clearer picture, let’s crunch some numbers. Suppose they have $50,000 in cash and $300,000 in brokerage accounts, with annual expenses of $100,000. Their Lt score stands at 3.5. To improve this score, the Johnsons would need to either increase their liquid assets or decrease their annual spending.

The Outcome: By focusing on these improvements, the Johnsons can strategically position themselves to not only make the down payment on their rental property but also maintain financial stability and flexibility. This proactive approach to managing their Lt enables them to navigate the complexities of their financial life with greater confidence.

🧭 Conclusion: Empowering Your Financial Journey with Lt Knowledge

Liquid Term isn’t just a number; it’s a compass guiding you through the financial seas. Understanding and optimizing your Lt can mean the difference between just staying afloat and cruising confidently towards your financial goals.

As always – stay on point!