When she stopped letting the hospital schedule her life, her income jumped by five figures.

She had full benefits. A steady paycheck. The comfort of being on payroll.

But between constant scheduling frustrations, a lack of flexibility, and feeling like her PTO requests just got tossed in a black hole, my CRNA client had had enough. She was giving 36 hours a week to her W-2 role and getting little say in return.

So she did what a lot of CRNAs are doing right now: dipped her toe into 1099 waters.

It gave her a taste of autonomy. And with healthcare already covered through her husband’s job, she saw a window to take back control of her time and her income.

She came to me with one question:

“If I’m going to work 36 hours a week, what’s the best way to structure it—W-2, 1099, or a mix?”

So we rolled up our sleeves and did what we love: crunch the numbers.

The Goal: Keep the Time, Maximize the Income

Her ideal scenario:

- Work 36 hours per week

- Keep her 7 weeks of paid vacation if possible

- See what happens financially if she drops to .50 W-2 status

- Compare hybrid options

- And finally, explore what happens if she goes all in on 1099

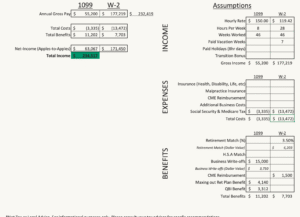

We modeled five different versions of this using her actual pay, tax rates, benefit assumptions, and business deductions.

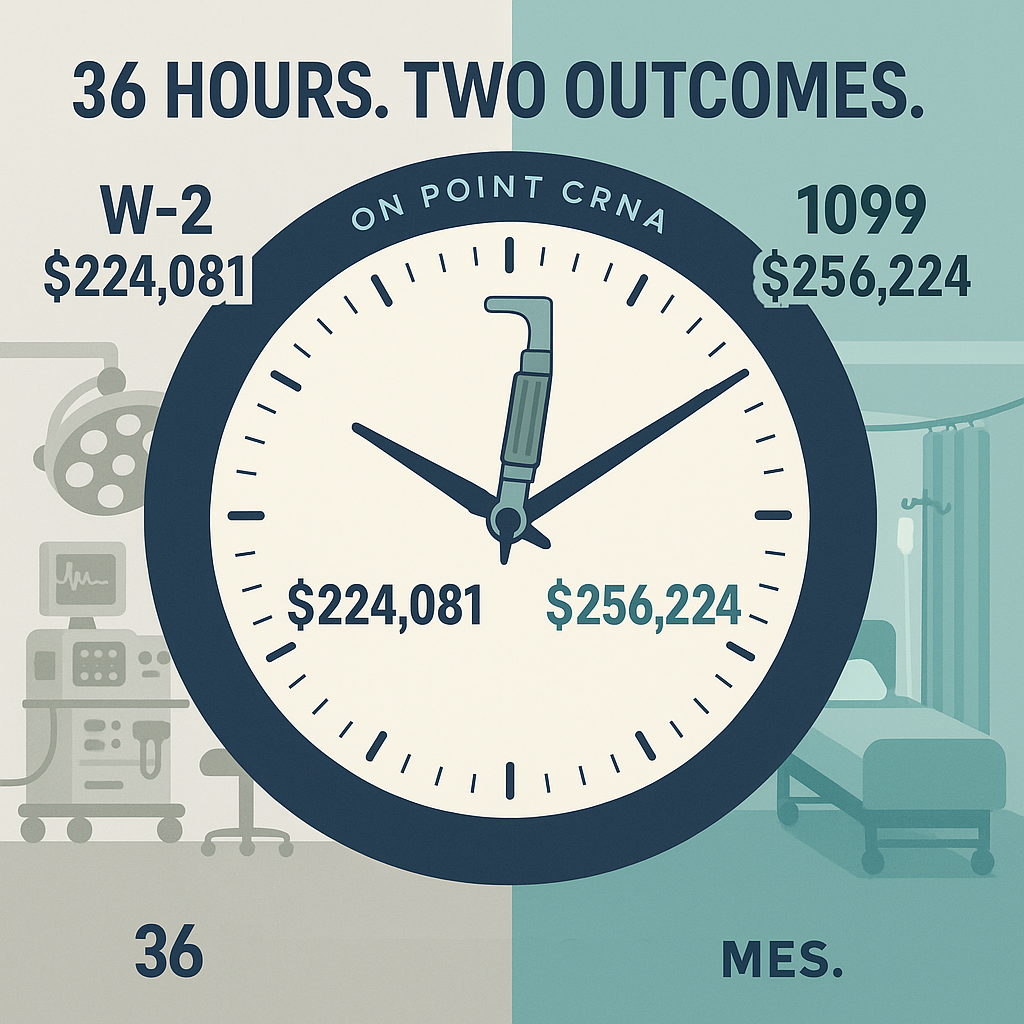

The Clear Winner: Full 1099 (36 Hours)

💰 Net Income: $256,224

🏥 W-2 Equivalent: $224,081

🔥 Advantage: +$32,143

Let’s not bury the lead. The 1099-only path gave her over $32,000 more with the exact same hours worked.

And this wasn’t some pre-tax trick. We leveled the playing field by assigning fair value to W-2 benefits like 401k match, CME, and PTO. Even after accounting for those, 1099 came out way ahead.

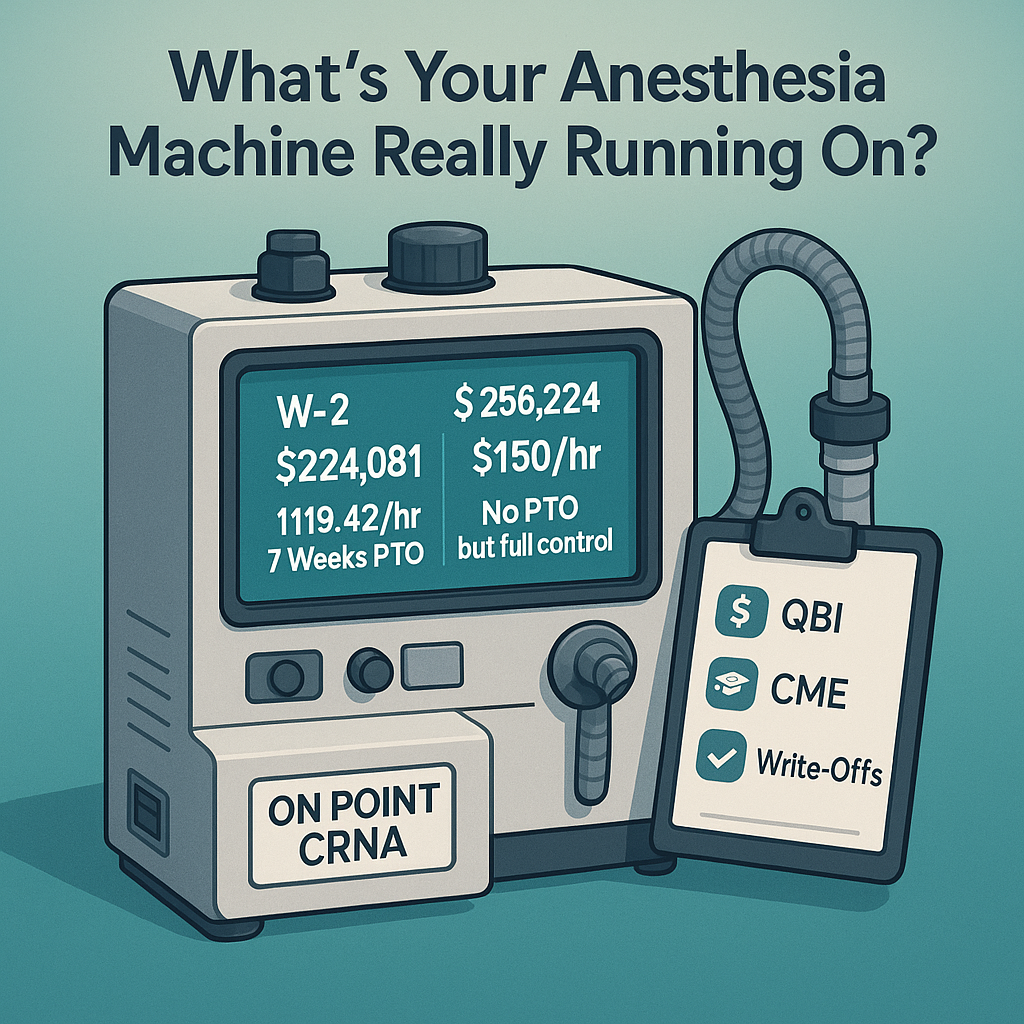

And the hourly difference told its own story:

- $150/hour as a 1099 CRNA (potentially much higher)

- $119.42/hour as a W-2 + 7 weeks of vacation if she stays above 0.50 status (20hrs/week)

Why 1099 Wins So Big

✅ Higher Hourly Rate

She earned $150 per hour as a contractor compared to $119.42 as W-2.

✅ S-Corp Election

We ran her 1099 income through an S-Corp, splitting it between salary and distributions. This reduced self-employment tax significantly, saving thousands.

✅ Maxed-Out Retirement Contributions

With a Solo 401(k), she contributed as both employee and employer. That’s a massive pre-tax savings opportunity compared to a capped W-2 match.

✅ QBI Deduction

The 20 percent Qualified Business Income deduction created a $7,700 tax break. That’s completely off the table for W-2 income.

✅ Business Write-Offs

Malpractice premiums, scrubs, licensing fees, CME, health insurance, home office expenses. All deductible. All working in her favor.

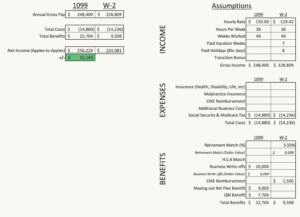

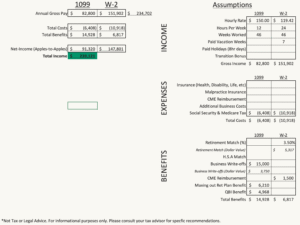

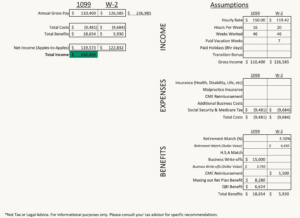

What About Mixing 1099 and W-2?

We tested a few hybrid approaches to see if she could keep her 7 weeks PTO and still grab some tax perks. Here’s how they stacked up:

| Scenario | Total Income |

|---|---|

| 36 Hours All 1099 | $256,224 |

| 16 hrs 1099 / 20 hrs W-2 | $242,405 |

| 12 hrs 1099 / 24 hrs W-2 | $239,121 |

| 8 hrs 1099 / 28 hrs W-2 | $234,517 |

| 36 Hours All W-2 | $224,081 |

So while a hybrid setup can strike a decent balance, the more hours she shifted toward W-2, the more money she left on the table.

Real Talk: Is 1099 Always the Right Move?

Not always.

1099 is amazing if you’re ready to handle your own:

- Taxes

- Retirement plan setup

- Expense tracking

- Insurance (if not covered elsewhere)

It’s a little more work. But for the right CRNA, especially someone who values autonomy, it is often worth tens of thousands of dollars.

“I just want to work, get paid well, and not be at the mercy of someone else’s schedule.” – actual client words

Sound familiar?

Want to See the Scenarios Side-by-Side?

If you’re a visual learner (or just love a good bar chart), I’ve got mockups that bring these comparisons to life.

📸 See each scenario broken down with visuals:

Want to See What Your Numbers Look Like?

If you’re a CRNA figuring out your ideal mix of W-2 and 1099 income, or wondering if now’s the time to make the leap, I can help you make the decision with clarity.

Book a call. I’ll run the numbers.

You’ll leave with a clear path, not a guess.

—

Disclaimer: This case study is based on real client modeling for educational purposes. Your specific tax results may vary depending on income, deductions, and whatever mood the IRS is in that week. There are quite a few assumptions made regarding expenses, retirement contributions, QBI phase-outs etc. This is not intended as tax advice.