“When my first backdoor Roth blew up thanks to the pro-rata rule, I had no idea why some of it was taxable.” This guide keeps you from making the same mistake.

Why the Backdoor Gets Messy

Spoiler alert: Nothing feels worse than discovering the IRS is quietly nibbling away at your Roth conversion because a dusty old traditional IRA is lurking in the background. If you’re stashing pre-tax dollars in an IRA and you want to keep backdoor Roth conversions on the menu, it’s time for a maneuver most CRNAs have never heard of—the reverse rollover into a Solo 401(k).

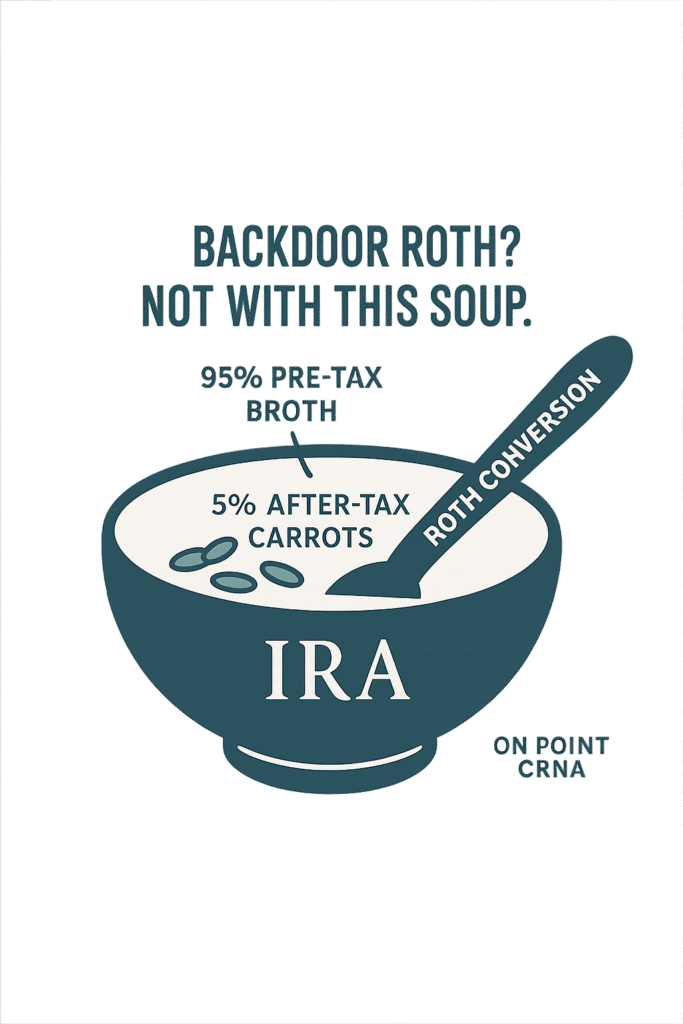

The IRS pro-rata rule treats every IRA you own—traditional, SEP, SIMPLE—as one big bowl of soup. If that soup is 95 % pre-tax broth and 5 % after-tax carrots, only 5 % of any conversion escapes tax. In other words, the backdoor Roth loses its magic.

It’s the IRS’s way of forcing you to treat every IRA dollar (pre-tax and after-tax) like one big pot. If you have $95k of pre-tax money and drop $5k of new after-tax money in, only 5% of any conversion escapes tax. Goodbye, “tax-free” backdoor.

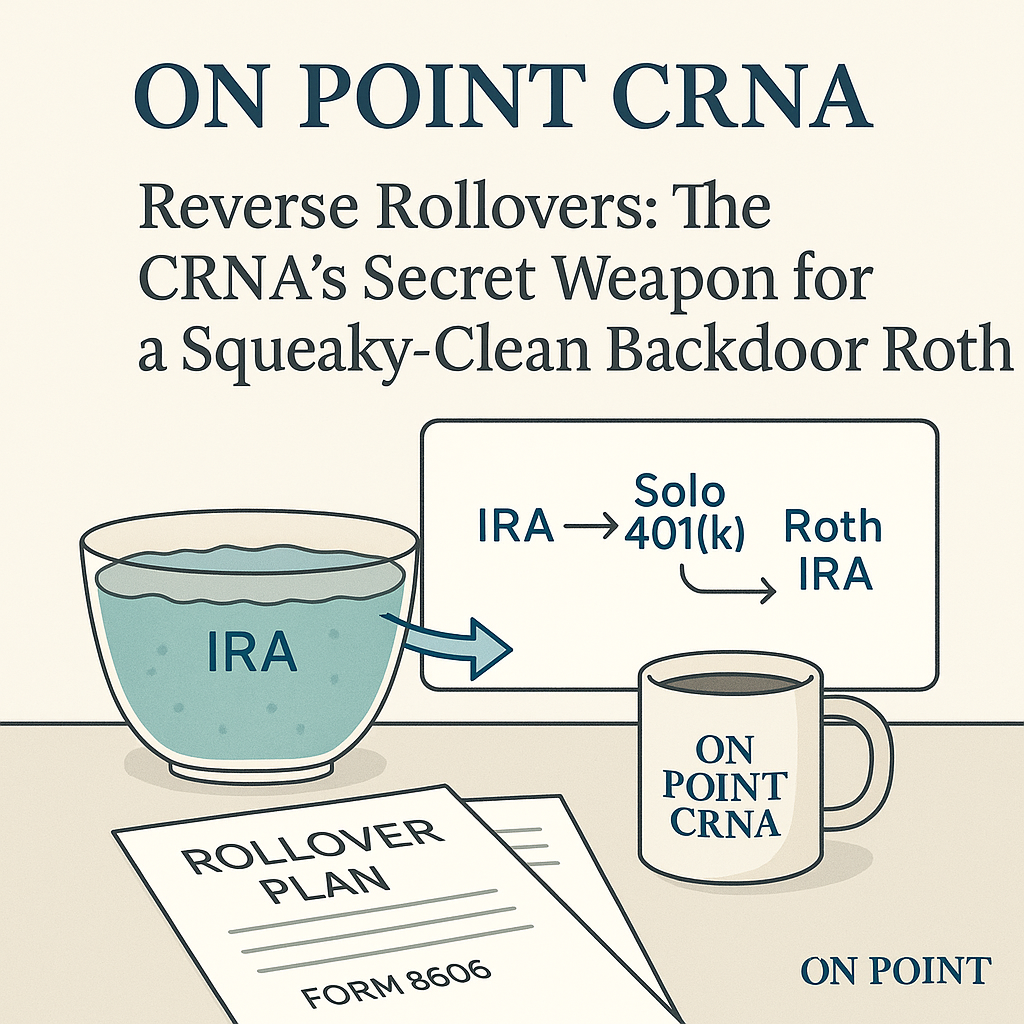

What Is a Reverse Rollover?

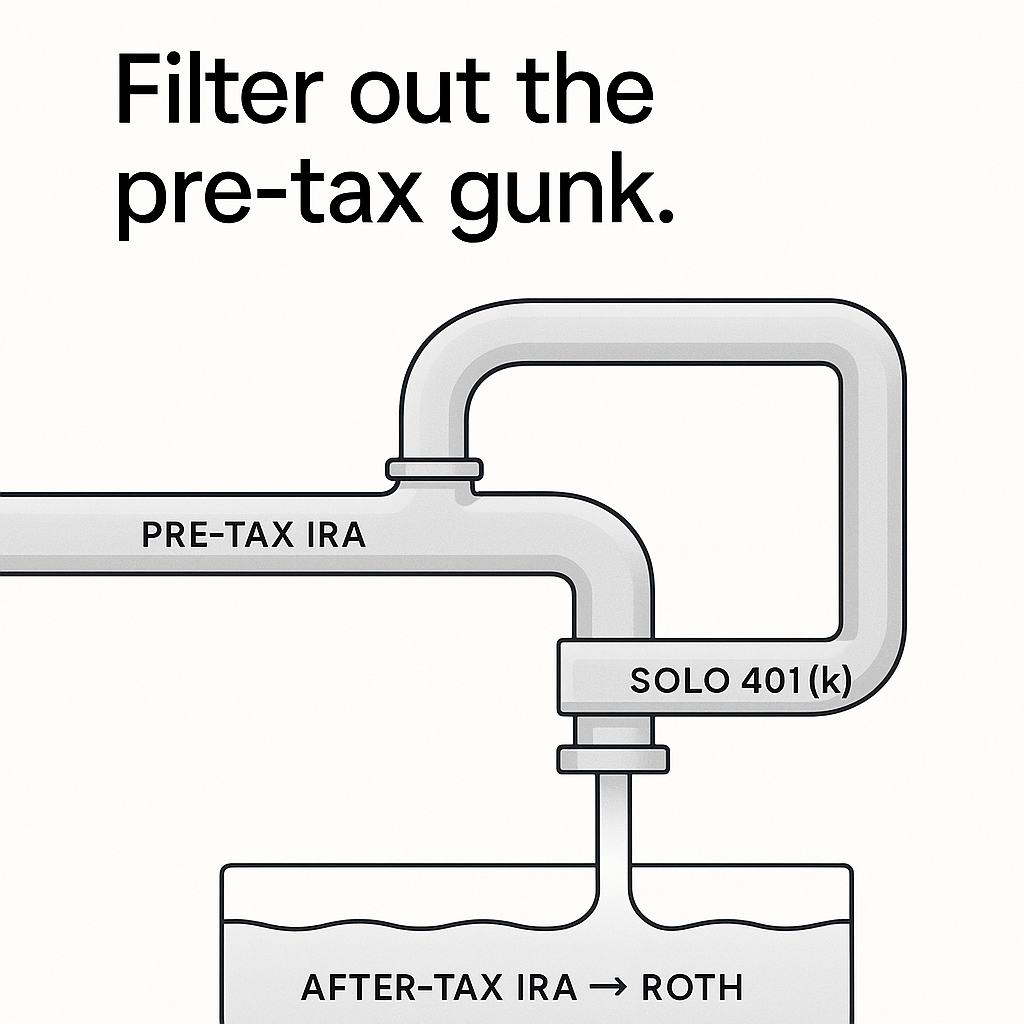

A reverse rollover moves your pre-tax IRA balance into an employer plan—your Solo 401(k)—so that on December 31 your traditional IRA shows $0 pre-tax dollars. No pre-tax balance, no pro-rata bite. Think of it as sending the messy broth to a new container and leaving only clean after-tax carrots behind.

Step-by-Step How-To

| Step | What to Do | Pro Tips |

|---|---|---|

| 1. Confirm self-employment | You need any 1099 income—even a weekend locum gig—to sponsor a Solo 401(k). | File Schedule C or an S-Corp payroll. |

| 2. Open a Solo 401(k) | Choose a custodian and be sure the plan docs allow roll-ins. | Fidelity’s “Self-Employed 401(k)” kit is famously no-fee. |

| 3. Request a direct trustee-to-trustee rollover | Call your IRA custodian and ask for a direct rollover of pre-tax dollars to the new plan. | Direct beats the 60-day do-it-yourself route (no 20 % withholding). |

| 4. Verify zero balance | Log in after the dust settles. Your traditional IRA balance should read $0 on December 31. | Leave any after-tax basis behind if you’re prepping for backdoor conversions. |

| 5. Execute the backdoor Roth | Make a non-deductible IRA contribution, then convert it to Roth ASAP. | File Form 8606 to track basis (your tax preparer will thank you). |

👉 Ready to tackle the paperwork? Start here and book a quick call so we can run the numbers together.

Is It Worth the Hassle?

Absolutely, especially if you’re already maxing your Solo 401(k) and drooling over more Roth space. Our Mega-Backdoor Roth guide shows how extra after-tax contributions can snowball into six-figure tax-free growth over a 25-year career. For the math nerds, we quantified the advantage for a typical 1099 CRNA earning $350k: an extra $1 millionin Roth assets by retirement. (Yes, we ran the Monte Carlo.)

Stack it with strategies from our Direct Indexing guide, and you’re cooking with anesthesia-grade nitrous oxide.

Extra Perks (Cherry on Top)

- Delay RMDs: Money sitting in a Solo 401(k) can often dodge required minimum distributions if you’re still working.

- Plan loans: Need quick liquidity? A Solo 401(k) can lend you up to 50 % of its value (max $50k) without triggering tax.

- Mega-backdoor potential: Some Solo 401(k)s let you add after-tax contributions and convert them in-plan—turbocharging Roth space.

Common Gotchas

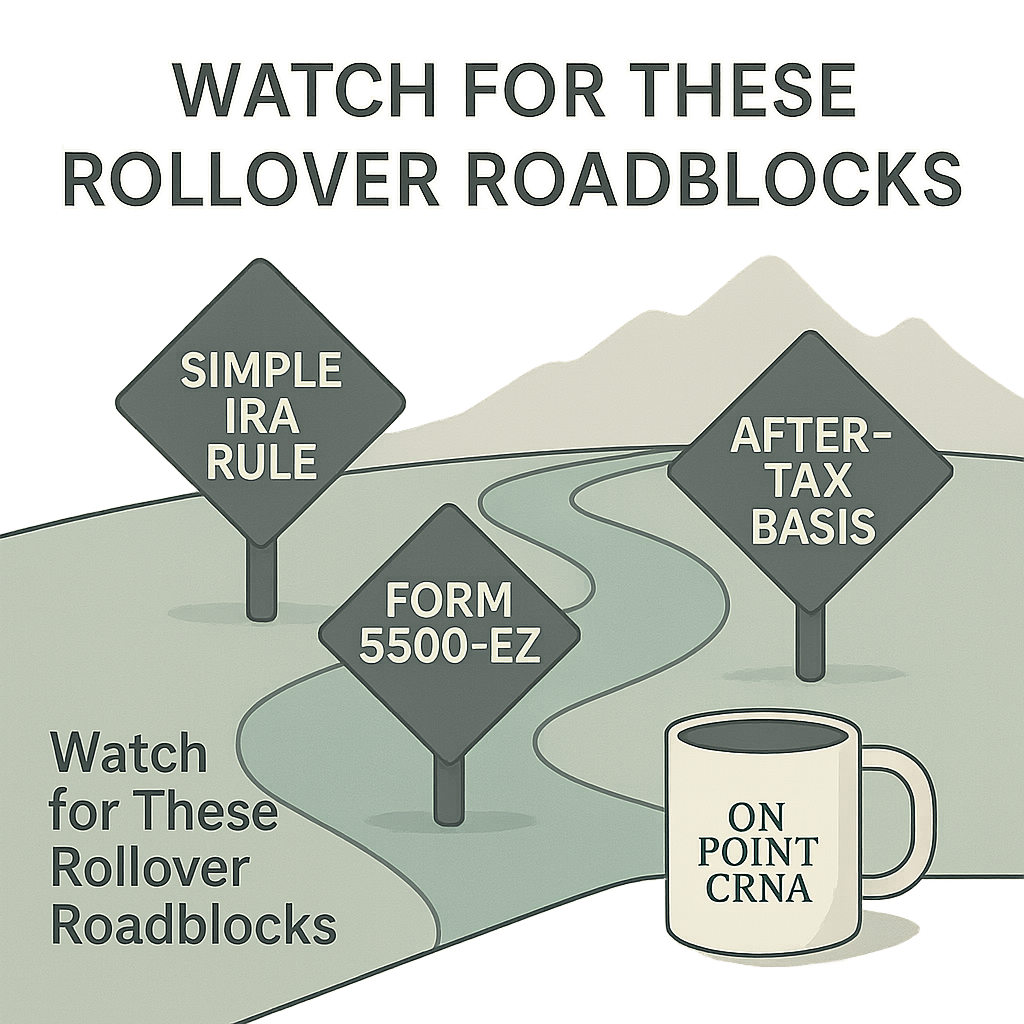

- SIMPLE IRA 2-year rule: Assets less than two years old can’t be rolled yet.

- Non-deductible basis: Leave after-tax dollars behind; only move pre-tax.

- Form 5500-EZ: File once Solo 401(k) assets top $250k.

FAQ

Do I need 1099 income to open a Solo 401(k)?

Yes—any self-employment net profit qualifies, even a single locum shift.

Can I roll a SIMPLE IRA into a Solo 401(k)?

Only after you’ve participated in the SIMPLE for at least two years, per IRS rules.

Will a reverse rollover affect my required minimum distributions?

If you keep earning self-employment income, the “still working” exception may delay RMDs from the Solo 401(k); confirm with your tax advisor.

Still on the Fence?

If you:

- Have pre-tax IRA dollars lingering from residency rollovers or a side hustle SEP, and

- Want the sweet, sweet nectar of an annual backdoor Roth—

…then a reverse rollover is the lowest-hanging fruit in your tax orchard. I’ve yet to meet a CRNA who said, “Gee, I wish I’d kept my IRA balance taxable.”

👉 Let’s map your exact numbers. Grab a spot on my calendar right here and we’ll see if a reverse rollover makes sense before year-end.

Disclaimer

Barnhart Wealth Management (DBA On Point CRNA) is a registered investment adviser in Michigan and other exempt jurisdictions. This content is for informational purposes only and does not constitute advisory services or the sale of securities. All views, expressions, and opinions are subject to change. Investing involves risk, including loss of principal. Comments and recognitions do not guarantee future results.