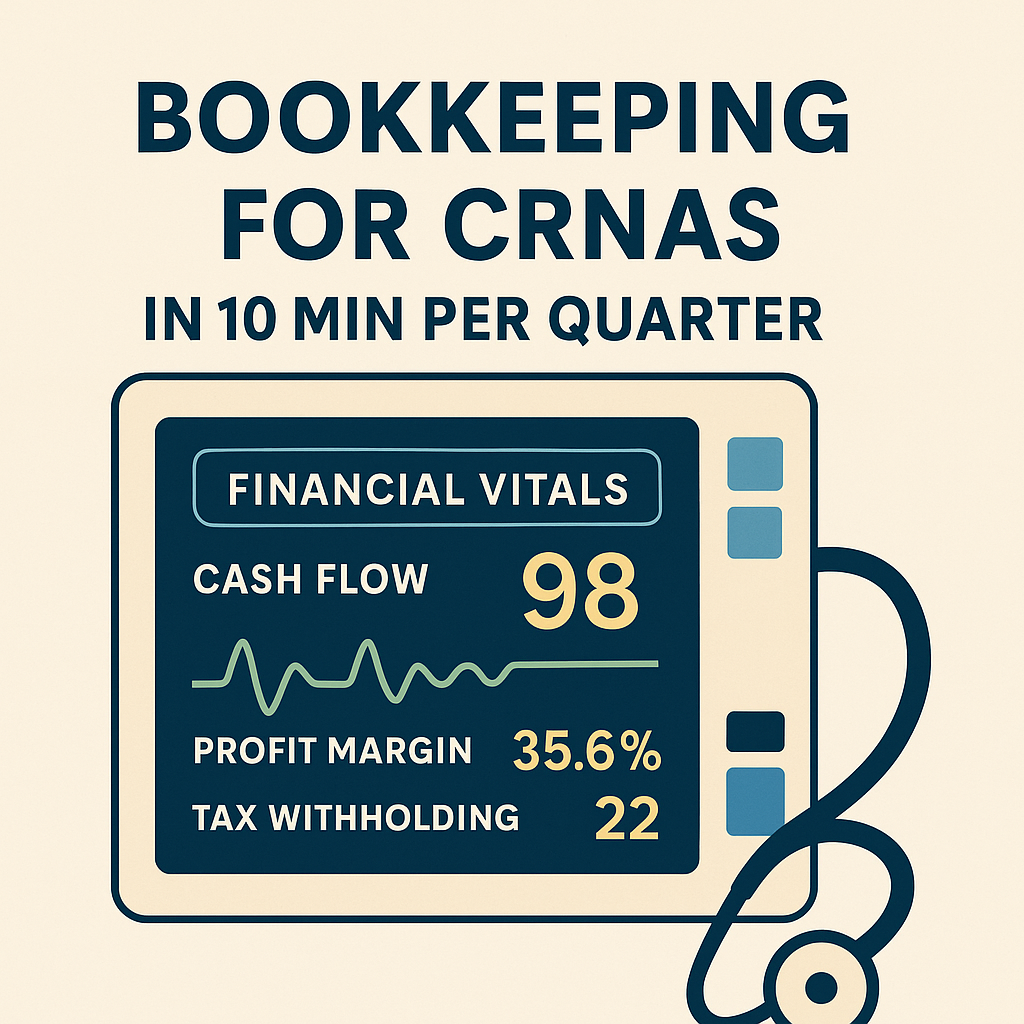

Imagine showing up for a case without knowing your patient’s vitals. For most CRNAs, that would be unthinkable. But when it comes to the financial “vitals” of their business, many are flying blind.

The good news? Keeping tabs on your finances doesn’t have to be complicated—or time-consuming. With the right tools and habits in place, you can stay organized, avoid surprises at tax time, and make smarter decisions for your practice.

Here’s how to get started.

Step 1: Know What Bookkeeping Really Is

Let’s clear this up: bookkeeping isn’t about “doing your taxes.” It’s about keeping a record of what’s coming in, what’s going out, and being able to answer one simple question—how is my business doing?

Whether you’re working with locum tenens groups, or managing your own 1099 work, you’re running a business. And just like you track patient data to inform care, tracking your business numbers helps guide better decisions.

Step 2: Start Simple (Yes, a Spreadsheet Works)

When you’re starting out, a spreadsheet can do the trick. Create columns for:

- Date

- Amount

- Category

- Description

This gives you a basic snapshot of your income and expenses. It doesn’t need to be fancy—it just needs to be consistent.

Step 3: Separate Business from Personal (ASAP)

If you haven’t already, open a dedicated business bank account. This makes everything cleaner—especially come tax time. Most banks will require your LLC paperwork and an EIN (Employer Identification Number), which you can get quickly from the IRS website.

Step 4: Use a Tool That Works for You

We recommend Xero (no affiliation—it’s just what we use personally and with our CRNA clients). It connects to your bank account, categorizes transactions, and can generate the financial reports your accountant will thank you for.

If you’ve made an S-Corp election, tools like Xero become even more valuable. That election comes with added responsibilities—like filing an 1120S tax return that includes a balance sheet (not just a list of expenses). Pair Xero with a payroll service like Gusto, and you can automate a lot of that complexity, including properly categorizing your payroll.

Step 5: Block 10 Minutes. Just Once a Quarter.

Here’s the part most CRNAs don’t believe at first: once you have a system in place, bookkeeping shouldn’t take more than 10 minutes per quarter. Really.

We recommend setting a recurring calendar reminder each quarter. Log into Xero (or your spreadsheet), make sure everything’s categorized, and you’re done. If anything looks off, make sure it’s reconciled with the statements for the last three months and categorized properly.That’s it.

Bonus: Use Our Chart of Accounts Template

One of the most common questions we get is: “What categories should I be using?” To take out the guesswork, we’ve created a simple Chart of Accounts you can download and start using today.

📂 Download Our CRNA Chart of Accounts Template

Final Thoughts

You didn’t go to school to become a bookkeeper—and you don’t need to be one now. But having a basic, organized system in place gives you clarity, peace of mind, and more freedom to focus on what you do best.

A few smart habits and the right tools can make your financial life a lot easier. If you’re looking to make sense of your business numbers or want help setting up your system, we’re here to help.