Picture this: you’ve wrapped a 16-hour shift, you’re finally home, and your brain is somewhere between Grey’s Anatomy reruns and a well-deserved glass of Pinot. In that hazy in-between, a little voice asks: “Could I actually afford to slow down—or even stop—if I wanted to?” That’s exactly the question Total Term (Tt) answers.

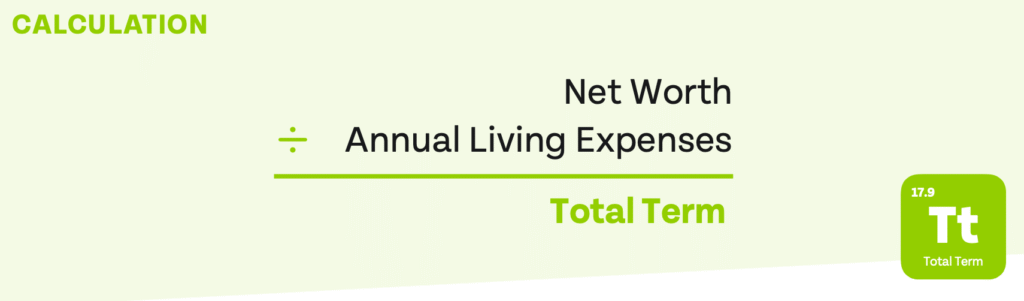

Tt tells you how many years your entire balance sheet could support your current lifestyle if nothing grew and nothing shrank. Translate that to CRNA-speak: it’s your runway to work-optional living. If you’ve got $1 million to your name and you spend $100k a year, your Tt is 10—meaning you could kick back for a decade before money worries start knocking.

Why Tt Beats a Plain-Old Net Worth Figure

- It’s in “years,” not “dollars.” Most brains grasp time far better than commas and zeros.

- It forces a reality check. A $1 million net worth feels baller… until you see it only funds six years of living large.

- It highlights diversification gaps. A lopsided asset mix (say, everything stuffed in a 401(k)) shows up instantly when you break Tt into its parts.

Breaking Down the Four Pillars of Tt

- Liquid Term (Lt) – cash, brokerage, anything you can tap without tax headaches.

- Qualified Term (Qt) – 401(k)s, 403(b)s, IRAs—the penalty crew.

- Real Estate Term (Rt) – equity in your home or rental properties.

- Business Term (Bt) – ownership in your 1099 side-gig or pain-clinic partnership.

Add them up and voilà: Total Term.

Three Steps to Put Your Tt on Steroids

Step 1: Nail the Inputs

Pull your latest net-worth snapshot and a brutally honest annual-spending total. Yes, Amazon orders count (guilty).

Step 2: Inspect the Score

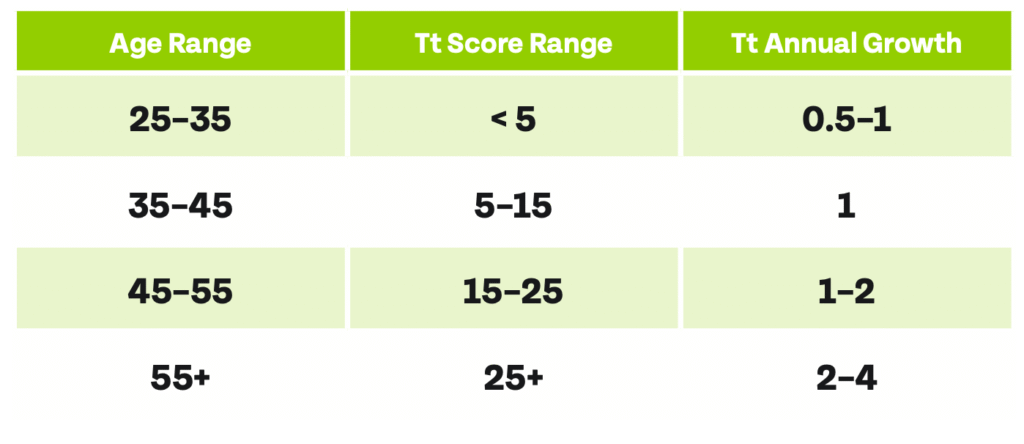

Tt doesn’t move linearly with age. In your early career, seeing a single-digit Tt can feel depressing—relax, it should ramp quickly once debt gets crushed and income stabilizes.

Step 3: Fix the Weak Links

Ask yourself:

- Is my savings rate high enough?

- Am I over-relying on one pillar (looking at you, house-rich folks)?

- Can I redirect cash flow—maybe open a Solo 401(k) or toss more toward brokerage—to balance the mix?

Perfect — let’s build a section that references both visuals in a way that fits seamlessly into your blog post and mirrors your style. Here’s the suggested section:

How Total Term Evolves Over Time (And Why That’s a Good Thing)

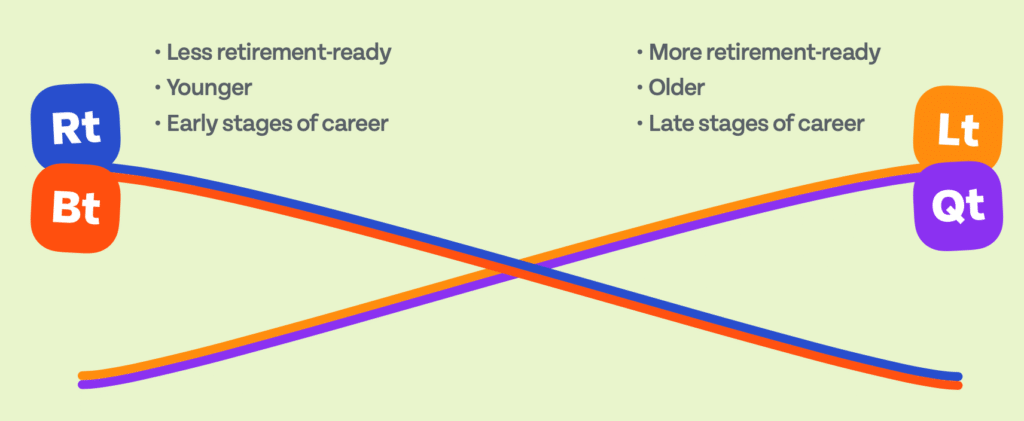

There’s a natural shift that happens as your career progresses — and it shows up beautifully in your Total Term breakdown. Check out the chart below 👇

In the early days of your career, most of your net worth lives in Business Term (Bt) and Real Estate Term (Rt) — maybe you’ve started your 1099 life, bought a home, or started building sweat equity in a side gig. That’s totally normal. At this stage, your Liquid and Qualified assets are still catching up.

But as time goes on (and compound interest works its magic), you’ll see a shift: Lt and Qt scores rise, signaling more traditional, accessible forms of retirement readiness. Less hustle, more options.

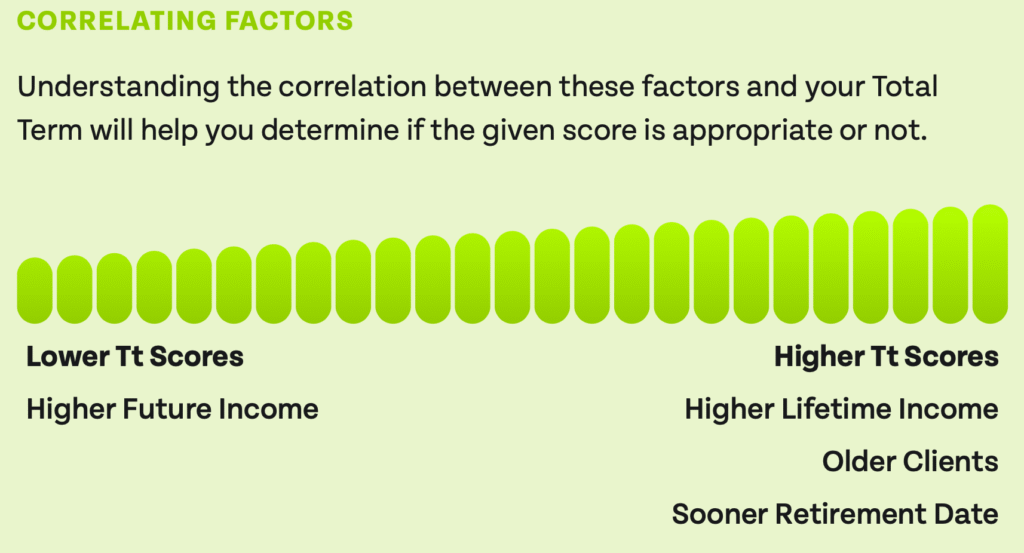

What Influences Your Total Term?

The image above says it all.

- Lower Tt Scores tend to show up in CRNAs with rising income potential, longer career runways, and more aggressive growth strategies.

- Higher Tt Scores typically show up in those further along the path: older, closer to retirement, and often with more stable (or even decreasing) income needs.

So, if your Tt feels low today but your income is on the upswing, take a breath. It’s not a red flag — it’s a stage of life.

The key is direction, not perfection.

Let me know if you’d like to embed the images directly or if you’d prefer me to break this section into a carousel or infographic format for your blog or IG.

A Quick Case Study (Names Changed to Protect the Sleep-Deprived)

Sophie, CRNA, age 45

- Lt: 2.0 years

- Qt: 6.5 years

- Rt: 1.0 year

- Bt: 4.0 years

- Total Term: 13.5 years

Sophie’s dream is partial retirement at 55. She’s short of the ~20 Tt we target for that timeline. The prescription: pump Lt with an automated taxable account, keep maxing the 401(k), and consider a Solo 401(k) for her 1099 work. Small tweaks, big runway.

What’s a “Good” Tt for CRNAs?

| Career Stage | Tt “Comfort Zone” |

|---|---|

| Early (≤35) | 3–6 |

| Mid (35–50) | 8–15 |

| Late (50+) | 15–25 |

Remember: these are guardrails, not gospel. Your personal mix of call shifts, rental houses, and beach-house dreams will nudge the target.

Ready to Calculate Your Own Tt?

Clients: it’s waiting for you in your Elements dashboard.

Not yet a client? Grab a latte, tally up your balances and annual spending, and run the math. If the number looks scary—or surprisingly awesome—shoot me a note. We’ll make sure your years line up with your life plans.

As always—stay on point!

Disclaimer:

Barnhart Wealth Management (DBA On Point CRNA) is a registered investment adviser offering services in Michigan and other jurisdictions exempt from registration. This content is for informational purposes only and does not constitute advisory services or sales of securities. All views, expressions, and opinions in this communication are subject to change. Investing involves risk, including loss of principal. Comments and recognitions do not guarantee future results.