What’s Your Tax Budget?

How Direct Indexing Lets You Play Offense in a Game Most Investors Don’t Know They’re Even In

High-income professionals—especially CRNAs, physicians, and other 1099 earners—often find themselves paying more in taxes than they’d like. Direct indexing offers a modern, tax-efficient strategy that gives you more control, more customization, and more opportunity to offset gains with losses. Before we unpack that, you might want to check out our guide on Safe Harbor & Estimated Payments for CRNAs to understand how CRNAs can proactively manage variable income and avoid penalties. Before we unpack that, you might want to check out our guide on Safe Harbor & Estimated Payments for CRNAs to understand how CRNAs can proactively manage variable income and avoid penalties.

In this article, we’ll break down how direct indexing works, who it’s for, and how it can help high earners lower their taxable income without changing their investment philosophy.

Let’s say you and I both own an S&P 500 ETF.

Same market exposure.

Same gains on paper.

Same “set it and forget it” vibe.

But here’s the kicker: I’m using direct indexing, which means I get to write off losses… and you don’t.

That’s not a typo. That’s a strategy.

It’s also one of the cleanest, sneakiest tax ninja moves available right now – especially for high earners.

Ready to see if direct indexing fits your tax plan? Schedule a no‑pressure consult.

ETFs: Good for Lazy Saturdays, Bad for Tax Strategy

Don’t get me wrong, ETFs are awesome. Low cost, diversified, tax-efficient… until they’re not.

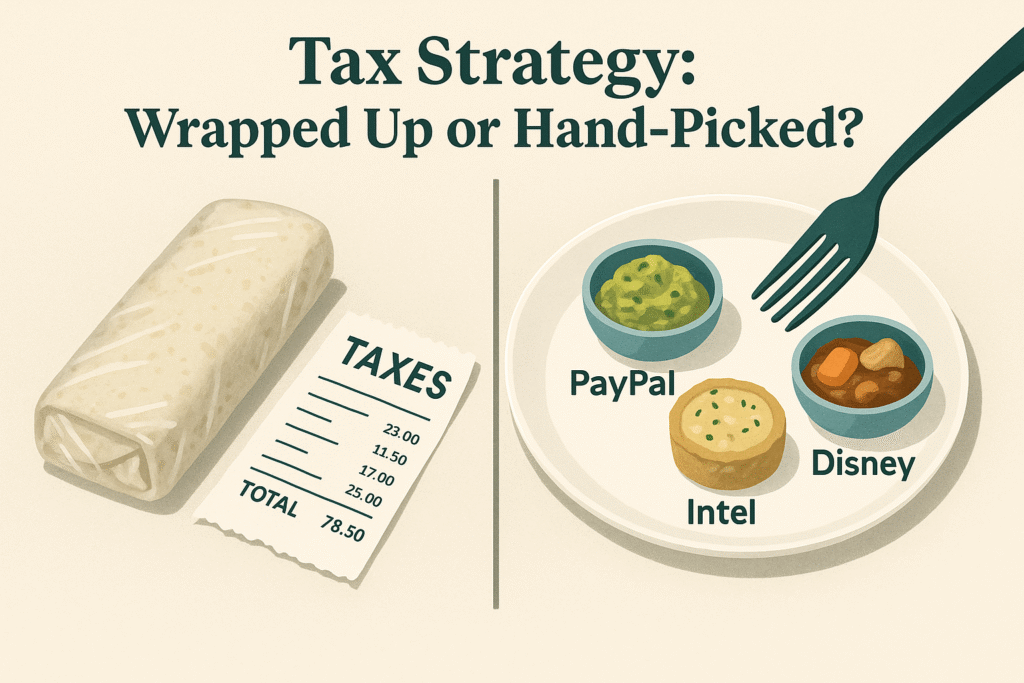

Let’s say PayPal, Intel, and Disney all take a nosedive inside your ETF. Down 20%. Oof.

Can you pluck out just those names and harvest the loss?

Nope.

The ETF is like a frozen burrito—everything’s all wrapped up together. You can’t separate the stale beans from the melty cheese. You just eat the whole thing and deal with the indigestion (in this case, zero tax benefit).

Direct indexing? That’s more like à la carte ordering. You get to pick, choose, and swap with intention.

Direct Indexing: Same Index, Just Sharper Tools

Direct indexing takes something like the S&P 500 and breaks it down into individual ingredients. You hold the stocks directly—200, 300, sometimes more.

Same general exposure.

Same strategy.

But now? You have flexibility.

If Disney tanks, you can sell just Disney. Lock in the loss. Offset a gain elsewhere. Reduce your tax bill. Sleep better.

It’s not about being clever—it’s about being in control.

Tax Alpha: A Fancy Phrase for “You Keep More of What You Make”

Vanguard estimates that direct indexing may add 1–2% in annual after-tax return through tax-loss harvesting. That’s not an opinion—that’s just math. If you’re juggling 1099 income and NIIT rules, you’re already familiar with the planning we discuss here in our post on CRNA non‑compete clauses and employment structure.

We call that “tax alpha.” I call it “money you didn’t have to hustle harder for.”

For a high-income CRNA juggling 1099 income, W2 withholdings, and the ever-annoying Net Investment Income Tax, this may be a valuable lever to consider.

Curious what 1–2% after‑tax alpha looks like in real dollars? Let’s run your numbers.

The Automation Layer

Here’s where this gets borderline unfair (in your favor):

When I implement direct indexing for clients, we:

- Harvests losses year-round (not just at the end of December)

- Defers gains until they qualify for long-term capital gain treatment

- Avoids wash sales automatically by swapping in similar, but not identical, positions

It’s like having a tax-savvy trading assistant who never sleeps. All behind the scenes.

Bonus?

You can even customize your portfolio around personal values—exclude oil majors, add ESG filters, or avoid companies that make your skin crawl. t’s investing with intention.

Not a Magic Wand (But Pretty Close)

A few trade-offs to be aware of:

- You’ll own hundreds of individual stocks. Translation: your tax forms will look more like a short novel.

- It’s not ideal for small accounts—$2,000 is the floor, but I usually recommend starting at $25k+ to make the juice worth the squeeze.

- There may be slight tracking error compared to a traditional ETF, especially if we customize heavily.

This strategy is not a fit for everyone, but for the right investor, the tax benefits can be substantial.

Who This Is Actually For

Let’s be honest—this isn’t for your friend who still has credit card debt and a Robinhood addiction.

But if:

- You’ve maxed your 401k, HSA, and Roth

- You’ve got $25k+ sitting in a taxable account

- You’re tired of watching capital gains eat your lunch

- You’ve got appreciated stock, variable income, or just want a smarter way to invest…

Then yes. This may be for you.

Final Thought: Don’t Tip Uncle Sam More Than You Have To

There’s no medal for overpaying taxes.

No thank-you note.

No IRS agent in a suit whispering, “Wow, this one’s a patriot.”

There’s just your money… and a smarter way to manage it.

Direct indexing isn’t just some shiny fintech trend. It may be the strategy behind a lot of quiet wealth-building that never shows up on CNBC.

Curious if this strategy makes sense for your situation?

I work with high-income professionals and CRNAs to optimize taxes and grow wealth without unnecessary complexity. Let’s talk—no pressure, no jargon.

Let’s see if you’re leaving money on the table—book your free 15‑min tax check‑in.

FAQs About Direct Indexing

Q: Is direct indexing only for the ultra-wealthy?

A: Not at all. While it’s most powerful at higher account balances, it’s becoming increasingly accessible.

Q: Will this replace my current ETFs or mutual funds?

A: Not necessarily. It may be an enhancement to your taxable account strategy, not a replacement for retirement accounts or more static holdings.

Q: Do I need a financial advisor to set this up?

A: Typically, yes—especially if you want integrated tax planning and proactive management. DIY platforms exist but don’t offer the same tax-loss harvesting automation or customization.

Important Disclosure:

This content is for informational and educational purposes only and should not be considered personalized investment, tax, or legal advice. Direct indexing may not be suitable for all investors. All investing involves risk, including the risk of loss. Consult with your financial advisor or tax professional to determine whether this strategy aligns with your financial goals.

Barnhart Wealth Management (DBA On Point CRNA) is a registered investment adviser offering services in Michigan and other jurisdictions where exempt. This content does not constitute an offer or solicitation of any securities or investment advisory services.