CRNA Financial Planning & Investment Management

Hi. We’re On Point CRNA 👋

Real-life financial planning, built for

CRNAs just like you.

★★★★★

“…whenever we talk about wealth and investing, always get asked who my financial planner is… Ben’s my guy! He’s amazing at what he does and takes the time to explain things and strategies whether you’re a beginner or advanced in the financial realm. Cannot recommend Ben enough! He’s made the transition from W2 to 1099 so much easier on me and I honestly couldn’t be more excited about we have accomplished and still have yet to accomplish together! 👏🏼”

Alyssa R.

CRNA

★★★★★

“…. I started working as a 1099 CRNA last year and was not sure how to navigate all the demands of keeping records and filing taxes as a PLLC. My husband is a farmer so is self employed as well. Ben was able to help both of us consolidate our funds and optimize our investments. Anytime I have a question I email Ben and he is quick to reply and help in whatever way he can.”

Chris F.

CRNA

★★★★★

“…we’ve had a great experience with On Point CRNA. Really appreciate that they understand the career and the financial planning that comes with it. They’ve helped us feel more organized, confident, and on track for our goals. Highly recommend to other CRNAs or couples looking for solid, personalized guidance.”

Glen & Katie K.

CRNA

★★★★★

“…Ben is a stand-up, personable guy who is an expert at finances and guiding others to financial independence. He is responsive and timely in all aspects of his business. He also takes great pride in providing excellent descriptions of his knowledge so that the client feels as well educated. I would personally recommend Ben to anyone looking to make the jump into CFP/CPA services.”

Hassan A.

CRNA

On Point CRNA has not provided any compensation for the testimonials shown. The testimonials shown have been selected from among all client feedback. To our knowledge, no other conflicts of interest exist regarding these testimonials.

FAQs

- What services do you offer?

- What can I expect if we work together?

- How do you get paid?

- How do I become a client?

Build it.

Grow it.

Share it.

Dream it.

Protect it.

Keep it.

Weekly

commentary

Quarterly

updates

Reporting

Semi-annual

meetings

Spring meeting

Fall meeting

A relationship with a fee-only fiduciary.

*Fee transparency is super important to us! We aren’t paid through commission, kickback, or other undisclosed revenue sources. We charge a flat fee plus a fee that’s a percentage of the value of the investments we manage. The fees may vary based on client complexity and/or days in a particular billing period—advisory services are provided via Barnhart Wealth Management.

Financial Planning & Investment Management are not offered separately.

Financial

Planning

$100 monthly*

+

Investment

Management

0.10% monthly*

Joining our community? Here’s what to expect.

Pencil us in.

Let’s commence this operation by securing a slot on our schedule.

Initial consult.

In this stage, we play “Financial Pre-Op,” where we do the financial equivalent of a full pre-operative evaluation. We need to understand your fiscal fitness, goals, and concerns. Because just like you wouldn’t want an LMA for that prone case, we want to ensure we’re the right fit for your financial wellbeing.

Your prep.

Before we reconvene, we’ll ask you to install our “Financial Stethoscope” app, aka Elements®. You’ll answer some key questions. Rest assured; it’s easier than passing boards – guaranteed to take under 10 minutes.

The deep dive.

Think of this as your financial “PAT.” We examine your data, double-check your goals, and ensure we’re still on the same page for full clearance.

Our diagnosis.

We wouldn’t dare suggest a treatment plan without a proper assessment and diagnosis first. We’ll confer to make sure our financial prescription is the perfect fit for your goals.

Prescription delivery session.

This is where we become fiscal anesthetists, prescribing a plan that translates financial jargon into plain English. You’ll see the difference we can make, right down to the last penny. We promise, it’ll be as satisfying as pulling off your mask after a 12-hour case!

Don’t miss another update. Subscribe.

Here’s the latest on the blog.

New Federal Loan Caps: What They Mean for SRNAs (and What To Do Now)

The Savvy CRNA’s Guide to Car Ownership & Tax Deductions (2025)

On Point Perspective · Your 2025Q3 Wrapped

Should CRNAs Still Elect PTET Under the New $40K SALT Cap?

CRNA Overtime Under OBBBA: Are You Actually Eligible?

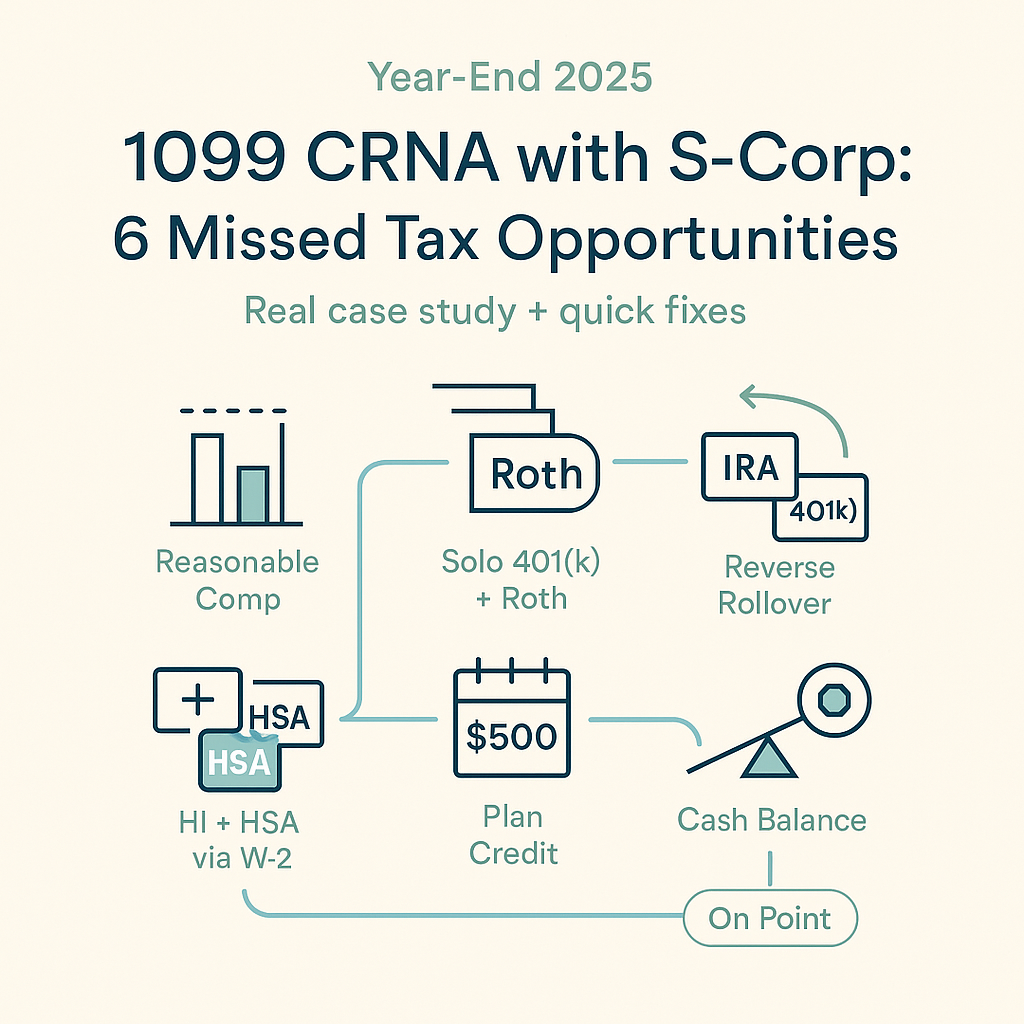

1099 CRNA with S-Corp: 6 Missed Tax Opportunities to Fix Before Year-End (Real Case Study)

Triage your money.

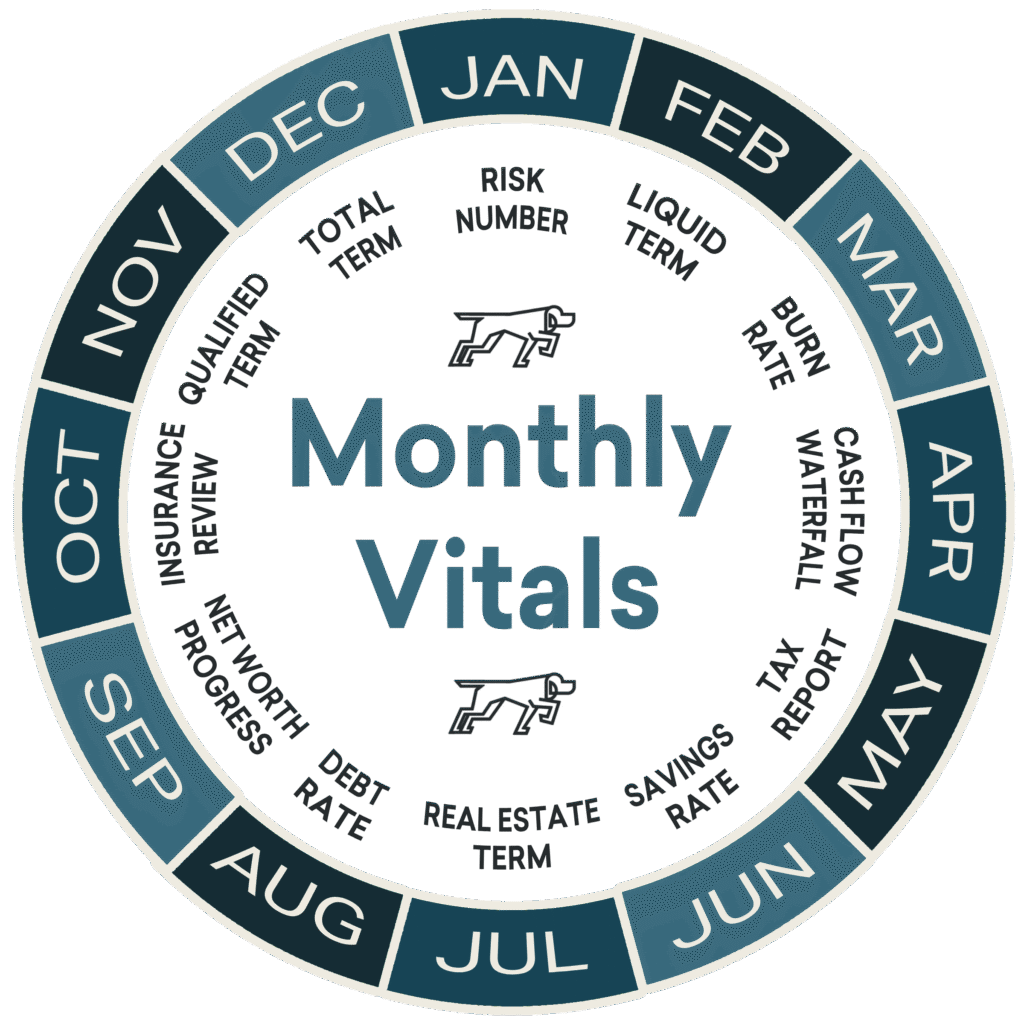

We use innovative software to serve as our financial stethoscope 🩺 for your wealth’s health, giving us the clarity and precision needed to assess your fiscal fitness swiftly.

Picture this: a Scorecard that, like a health checkup, lays out your entire financial panorama with 11 simple metrics. It’s not just about numbers, though. Imagine a dashboard where every asset and debt is tracked as if they’re vital signs, ensuring your next financial moves are on point. It’s your first step towards financial well-being.

CRNAs, ready for a fiscal fitness test? 🏥

Hop over here for more info and to grab your free financial check-up. It’s a game-changer for your financial wellness! 💼 📈