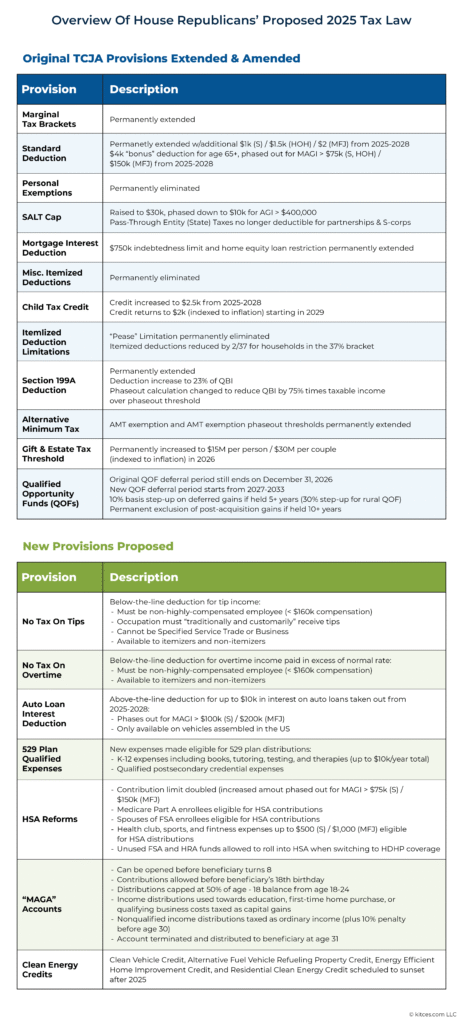

Congress might not extend all of the TCJA, but they are tossing some wild new deductions your way. Let’s talk through the ones that might actually help.

Before we dive in—this bill has passed the House as of May 2025, but it still has to clear the Senate before anything becomes law. So while we’re watching these provisions closely, we’re not etching anything into granite just yet.

Also: none of this is tax advice. It’s just the kind of stuff I’d be talking about with friends over a bourbon or during a CRNA tax planning meeting—hypotheticals with strategy in mind.

Cool? Cool.

The Government Might Let You Deduct the Interest on Your Truck Loan Now

You know all those years we told clients, “Nope, car loan interest isn’t deductible anymore unless it’s for a business vehicle”? Yeah, well… Congress is apparently bored.

There’s a proposed above-the-line deduction for vehicle loan interest—up to $10,000.

It applies to cars, trucks, motorcycles, RVs, ATVs… basically if it has wheels and was assembled in the U.S., it qualifies.

You’ll need to take out the loan after 12/31/2024, and the deduction phases out if your income creeps above $200k (MFJ) – so unfortunately, not many CRNAs will qualify.

HSAs Just Got Way More Jacked

This one’s a big deal. Starting in 2026, the proposed limits on HSA contributions go from already-good to borderline ridiculous:

- Individual: from $4,400 → $8,800

- Family: from $8,750 → $17,500

That’s not a typo. That’s $17,500 of tax-deductible money for the same medical expenses you already have.

And just to sweeten the deal, they’re finally letting you:

- Contribute even if you’re on Medicare Part A

- Use HSA dollars for gym memberships and fitness classes (but not CrossFit, hunting lodges, or private golf clubs—Congress does draw the line somewhere)

🧠 CRNA takeaway: If you’re already maxing your HSA, good. If you’re not, come talk to me—we might need to tweak how your S-Corp payroll is structured so you can take full advantage of the new limits should this become law.

“No Tax on Overtime” (Unless You Actually Make Money)

Congress also proposed a deduction for overtime pay. Sounds great, until you get to the part where it phases out if your prior-year comp exceeds $160k.

So yeah—probably doesn’t apply to you, unless you’re still in the final stretch of SRNA life.

But hey, if your spouse or college-age kid picks up a side hustle, this might be worth knowing.

“No Tax on Tips” – For the Waitstaff in Your Life

This is another below-the-line deduction (so you don’t have to itemize to claim it), and it’s aimed at folks in industries where tipping is customary.

If you’re thinking “Not my monkeys, not my circus”—you’re right.

But if you’ve got a kid waiting tables at Texas Roadhouse or slinging lattes this summer, their tax return just got more interesting.

529 Plans Just Got Smarter

We’ve always liked 529s for saving toward college. Now they’re expanding what counts as a qualified expense:

- Curriculum, books, and testing fees for K–12

- Therapy and tutoring for kids with learning challenges

- Continuing ed and credentialing programs (hello, CE credits)

Even better: if you’re paying for post-graduate CE or certifications, this now opens up a planning conversation around using a 529 for yourself (or your spouse, or your kid).

📚 TL;DR: 529s are becoming the Swiss Army Knife of education planning.

Meet the “MAGA” Account—Because Apparently We Needed Another Kid’s Account

No political spin here, just explaining what’s in the bill.

The MAGA account is sort of a hybrid between a Roth IRA and a 529. It:

- Allows $5,000/year in after-tax contributions

- Grows tax-deferred

- Allows tax-advantaged withdrawals for first homes, education, or starting a small business

One catch? The account has to be opened before the kid turns 8, and it must be emptied by age 31.

🤷♂️ Not the worst thing I’ve seen. But if you’re already using Roth IRAs and 529s to their full potential, this is more “nice to know” than “must have.”

Also, the federal government wants to kick-start these with $1,000 contributions at birth for babies born between 2025–2028. Which is… actually kind of cool.

Clean Energy Credits Might Vanish Sooner Than You Think

These were supposed to last until 2032. Now they’re getting pulled back to 2025.

So if you’ve been thinking about:

- Buying an EV

- Installing solar

- Upgrading HVAC or windows

…you may want to make moves this year. After 12/31/2025, some of these credits go away or shrink dramatically.

Section 199A: The 1099 CRNA Deduction We All Know and Love (Is Getting Tweaked)

If you’re a CRNA with 1099 income Section 199A is your best friend. This is the 20% deduction on your Qualified Business Income (QBI)—aka the IRS’s way of saying “Congrats on being self-employed, here’s a coupon.”

Under current law:

- You get a 20% deduction on your QBI, unless you make too much money (more on that below).

- It completely phases out for CRNAs over certain income thresholds (because we’re in a “specified service business” like doctors, lawyers, and financial advisors).

- $197,300 (single)

- $394,600 (married filing jointly)

So if you’re a married CRNA making $500k of taxable income? No QBI deduction. Just vibes and withholding.

Here’s what the new proposal does:

- The deduction becomes 23% instead of 20% (yay).

- But instead of a gradual phaseout, it uses a 75% reduction cliff: For income above the $394,600 MFJ threshold, your deduction gets reduced by 75 cents on every dollar over the limit.

CRNA Scenario:

Let’s say you’re married, and your taxable income is $500,000. You have $600,000 of QBI.

- Current Law: You get $0 in deduction. Fully phased out.

- Proposed Law: You’d still get a $58,950 deduction. Not perfect, but way better than zero.

Planning Tip: For CRNAs who bounce above the threshold some years, this new rule gives us a window to strategically manage income—delaying invoices, adjusting payroll, or timing 401(k) contributions to stay under the cliff (or just less over it).

SALT Deduction Cap: Less Salty, Still Limited

The State and Local Tax (SALT) deduction cap has been a pain for high earners since 2018, especially for CRNAs in high-tax states like California, New York, or Michigan (shout-out to Lansing’s income tax… why are we like this?).

Current law: $10,000 SALT deduction limit. Period.

Proposed change: Raise the cap to $30,000 for MFJ (starting 2026).

Sounds generous, right? But wait—there’s a phaseout twist:

- If your AGI is $400k–$500k (MFJ), the deduction phases back down to $10k

- Above $500k? You’re basically back where you started

And yes—this phaseout is cliff-style, not gradual. So, one year you’re in the clear, and the next you’re back to eating full state income tax with no federal offset.

CRNA Take: It’s better than the current $10k cap… unless you’re over those limits.

Final Thought: Ignore the Noise—Focus on What’s Actionable

Nobody knows what version of this bill will pass the Senate. It might get watered down. Some of this stuff might get scrapped. But these are real proposals, and they show where Congress’s head is at.

So instead of playing wait-and-see, let’s build optionality into your plan:

- Want to max the new HSA limits? Let’s adjust payroll accordingly.

- Thinking of buying a new business-use vehicle? Let’s look at the timing.

- Need to fund CE for yourself or your kid? Let’s use the right account.

Ready to Walk Through Your Next Tax Move?

Whether it’s optimizing for these new rules or shoring up your 2025 strategy, we’ll make sure you’re a step ahead of whatever Congress decides to do next.

Legal note (because we have to say it): This blog post is for informational purposes only and should not be taken as tax advice. Everyone’s situation is different—especially with proposed laws that haven’t been finalized. Talk to your CPA or financial advisor (hi, that’s me) before taking action.