Minimal prep. Maximum peace of mind for busy CRNAs.

A fast pre‑op to see if we’re a fit. Then we take over the charting.

-

Pencil us in.

Let’s commence this operation by securing a slot on our schedule.

-

Initial consult.

In this stage, we play “Financial Pre‑Op,” where we do the financial equivalent of a full pre‑operative evaluation. We need to understand your fiscal fitness, goals, and concerns. Because just like you wouldn’t want an LMA for that prone case, we want to ensure we’re the right fit for your financial wellbeing.

-

Your prep.

Before we reconvene, we’ll ask you to install our “Financial Stethoscope” app, aka Elements®. You’ll answer some key questions. Rest assured; it’s easier than passing boards—guaranteed to take under 10 minutes.

-

The deep dive.

Think of this as your financial “PAT.” We examine your data, double‑check your goals, and ensure we’re still on the same page for full clearance.

-

Our diagnosis.

We wouldn’t dare suggest a treatment plan without a proper assessment and diagnosis first. We’ll confer to make sure our financial prescription is the perfect fit for your goals.

-

Prescription delivery session.

This is where we become fiscal anesthetists, prescribing a plan that translates financial jargon into plain English. You’ll see the difference we can make, right down to the last penny. We promise, it’ll be as satisfying as pulling off your mask after a 12‑hour case!

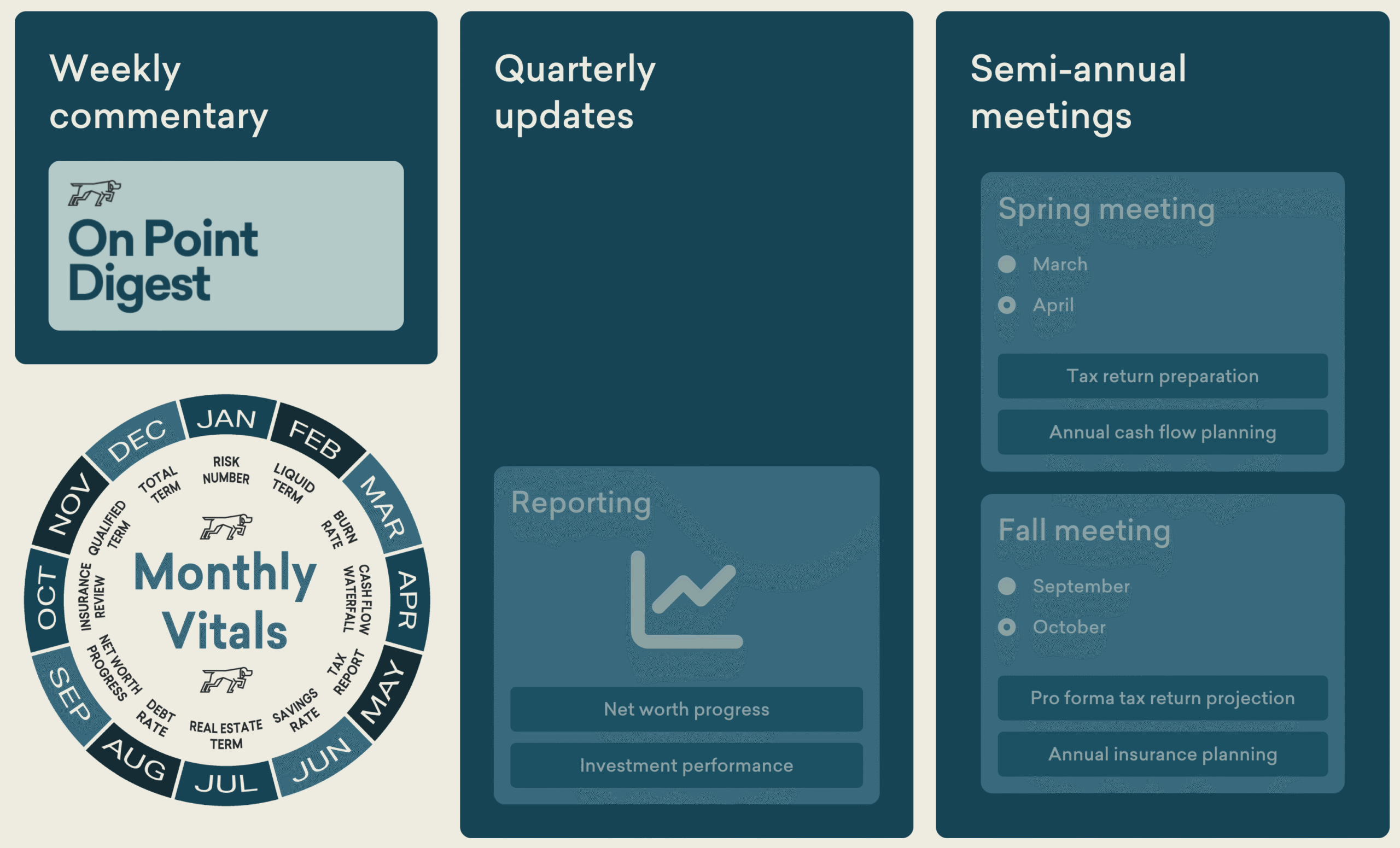

After onboarding, here’s what you can expect.

The On Point Client Experience